Master Competitive Intelligence Gathering Strategies

Competitive intelligence is all about understanding the world outside your own four walls. It’s the process of ethically gathering, analyzing, and using information about your competitors, your market, and the latest industry trends. This isn't corporate espionage; it's about turning publicly available data into a powerful business advantage. Think of it like a pro sports team studying game tapes before a championship match—they want to know every move the opponent might make.

What Is Competitive Intelligence Gathering

Imagine trying to navigate through a thick fog with no map. That’s what it feels like to run a business without good competitive intelligence (CI). You might know where you are, but you have no clue where anyone else is, what’s coming up, or where the best opportunities are hiding. Competitive intelligence is the map and compass that clears that fog.

It involves a systematic effort to collect information about your rivals and the market they operate in. We're talking about going way beyond a quick peek at a competitor's homepage. Instead, it’s a focused mission to understand their strategies, their strengths, and, most importantly, their weaknesses so you can make smarter decisions for your own business.

The real goal is to turn raw data into actionable insights. For instance, knowing a competitor dropped their price is just data. Understanding why they dropped it—say, to offload old inventory before a big product launch—that’s intelligence.

The Value of Proactive Insight

The true power of CI is that it lets you be proactive, not reactive. Instead of getting caught off guard by a competitor’s flashy new marketing campaign, a solid CI program helps you see it coming. That kind of foresight is a massive advantage.

"Competitive intelligence isn’t just about knowing the competition. It’s about equipping your organization with insight—not assumptions—so that every major decision is grounded in external reality."

This kind of strategic thinking supports almost every part of a business, from product development and marketing to sales and long-term planning. And it’s not just a nice-to-have anymore. The global CI market, valued at USD 50.87 billion, is expected to more than double by 2033. That tells you something big: CI has become a core strategic tool for any modern business that wants to win. You can dig into the full market report to see what’s driving this shift.

Competitive Intelligence vs Market Research

People often use the terms "competitive intelligence" and "market research" interchangeably, but they have very different jobs. Let’s clear that up.

The simplest way to think about it is this: market research looks at the big picture, while competitive intelligence zooms in on the specific players.

| Aspect | Competitive Intelligence | Market Research |

|---|---|---|

| Primary Goal | Understand and anticipate competitor actions to gain an advantage. | Understand the broader market, customer needs, and industry size. |

| Scope | Narrow and deep; focused on specific rivals, their products, and strategies. | Broad and wide; looks at the entire market landscape and customer segments. |

| Key Question | "What is our competitor's next move and how should we respond?" | "What do customers in our target market really want?" |

| Output | Actionable insights to inform specific strategic and tactical decisions. | General market understanding, trend analysis, and customer personas. |

Think of it like this: market research tells you there's a hungry crowd, while competitive intelligence tells you what the food truck across the street is putting on its menu.

Both are absolutely essential. But CI gives you that sharp, comparative edge you need to outmaneuver the competition. It helps answer the most critical question in business: "Given what everyone else is doing, what should we do next?" That’s why competitive intelligence gathering is a non-negotiable process for any company serious about growth.

Core Methods for Gathering Intelligence

Good competitive intelligence isn't about throwing darts in the dark; it's a structured process of piecing together information from all over the place. You have to think like a detective building a case. You'd never rely on a single witness, right? Same goes for CI. Relying on just one source of data is a recipe for disaster.

The ways you gather this info generally fall into two buckets: primary and secondary research. Each one gives you a different piece of the puzzle. Lean too heavily on one, and you'll end up with some serious blind spots. But when you combine them, you get a solid, well-rounded view of what’s really going on.

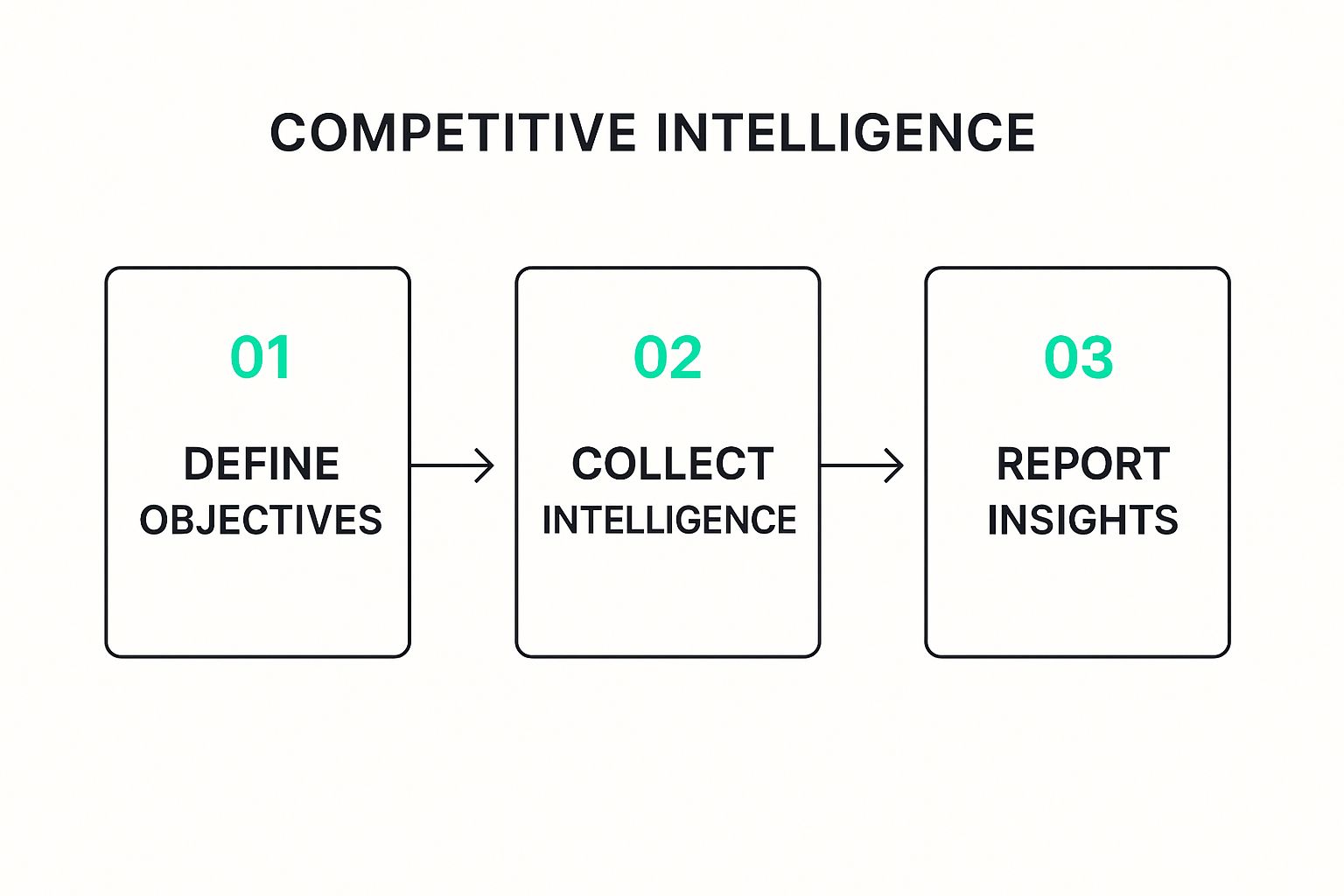

This flow chart breaks down the high-level process, from planning all the way through to reporting.

As you can see, gathering the intel is the main event, but it only works if you know what you’re looking for from the start and you’re ready to make sense of it all afterward.

Tapping into Primary Sources

Primary research is all about getting information straight from the horse's mouth. This is where you find the firsthand accounts and unfiltered opinions you can't just look up in a report. It’s about getting out there and talking to actual people to understand the human side of the data.

These methods are fantastic for figuring out the "why" behind what’s happening in the market.

Customer Interviews and Feedback: Just ask. Talk to your customers—and even your competitor's customers—about their experiences. What drives them crazy? Why did they pick one company over another? This kind of feedback is pure gold for your product and marketing teams.

Trade Shows and Conferences: Industry events are basically information buffets. You can sit in on a competitor's presentation, chat with their sales folks, and network with other people in the industry to get the real on-the-ground story.

Sales Team Debriefs: Your sales team is in the trenches every single day. They hear directly from prospects about who else they’re talking to and why. Setting up regular check-ins can uncover competitor pricing, sales tactics, and what objections keep popping up.

Leveraging Secondary Sources

Secondary research, on the other hand, is about digging into information that’s already publicly available. This is where you collect the hard data and documented facts that give your primary findings some much-needed context and scale. If you know where to look, the digital world is overflowing with this stuff.

Secondary sources provide the verifiable facts and broad-stroke trends, while primary sources add the crucial context, nuance, and sentiment that data alone cannot capture.

This type of intelligence work is often easier to scale and can even be automated, giving you a steady stream of signals from the market.

Key Secondary Sources Include:

Competitor Websites and Marketing Materials: A competitor's own website, blog, and press releases are their official story. They’re telling you exactly how they see themselves, what their product does, and where they’re headed. Keeping an eye on these for changes can tip you off to a shift in their strategy.

Public Financial Reports: For any publicly traded rival, quarterly earnings calls and annual reports offer a deep dive into their financial health and priorities. It’s amazing how many people skip these, but they’re packed with valuable intel.

Social Media and Online Forums: Places like LinkedIn, X (formerly Twitter), and Reddit are filled with honest-to-goodness conversations. You can track what people are saying about a brand, what they're complaining about, and what trends they're discussing. This is the heart of social listening, a must-have for modern CI.

Job Postings: You can tell a lot about a company's direction by who they're trying to hire. A sudden rush to hire a dozen AI engineers or a new sales team in a specific country? That tells you exactly where their money and focus are going.

By blending direct, human-to-human engagement with a thorough analysis of public data, you build an intelligence program that actually works. This balanced approach tells you not only what your competitors are up to but why it matters to your business. By the way, this same principle is a cornerstone of effective B2B lead generation, where knowing the competitive landscape helps you position your own outreach perfectly.

Essential Tools for Modern Intelligence Gathering

Trying to gather every last piece of competitor data by hand is like trying to map the ocean from a rowboat. You might make some progress, but it’s slow, exhausting work, and you’re guaranteed to miss almost everything happening just beneath the surface. Today, a powerful suite of digital tools does the heavy lifting, freeing your team up to focus on smart analysis instead of endless data collection.

Think of these tools as your advanced sonar and satellite imagery. They scan the digital world around the clock, picking up on faint signals you’d never find on your own. This technology turns competitive intelligence from an occasional project into a continuous, real-time function that keeps you agile and ahead of the curve.

The market for competitive intelligence tools was valued at around USD 452.4 million globally, and it’s not slowing down. Projections show it will grow at a compound annual growth rate of about 12.6%, hitting nearly USD 1.49 billion by 2034. This growth is all about the increasing demand for real-time insights. You can discover more about these CI tool market trends to see just how much businesses are investing in this space.

SEO and Digital Footprint Tools

If you want to understand a competitor's strategy, you have to start with their online presence—and SEO tools are the perfect lens for this. These platforms deconstruct a rival’s website performance, revealing their content strategy, keyword targets, and overall search engine visibility. It’s like getting a peek at their digital marketing playbook.

Using these tools, you can answer some critical questions:

- What keywords are they ranking for? This tells you which customer problems and product features they're prioritizing.

- Who is linking to them? A look at their backlink profile reveals their industry authority, key partnerships, and recent PR wins.

- How much traffic are they getting? Traffic estimates help you benchmark your own performance and pinpoint their most popular content.

This intel is pure gold for finding gaps in their strategy you can exploit. For example, if a major competitor is ignoring a valuable long-tail keyword, that’s an immediate opportunity for your content team to jump on.

Social Listening Platforms

While SEO tools show you what companies say about themselves, social listening platforms reveal what everyone else is saying about them. These tools monitor millions of conversations across social media, forums, and blogs to capture unfiltered public sentiment. It’s the digital version of being a fly on the wall in thousands of customer conversations at once.

Social listening gives you access to the world’s largest and most honest focus group. It moves beyond polished press releases to capture raw, candid feedback about your competitors, their products, and your industry.

These platforms are non-negotiable for modern CI because they provide real-time feedback on what’s happening in the market. You can track reactions to a competitor’s new product launch, spot common customer complaints they aren't addressing, or even see a PR crisis brewing before it hits the headlines. This gives you a massive strategic advantage, letting you react to market shifts in near real-time. Many of these platforms also use AI to identify high-intent conversations, a concept central to modern outreach. Check out our complete guide to AI lead generation tools to see how this technology is changing the game.

Dedicated Competitive Intelligence Suites

For companies that want a more unified approach, dedicated CI suites pull data from multiple sources into a single, cohesive dashboard. These platforms often combine information from web traffic, social media, ad spending, news mentions, and even company financials. They're designed to be the central command center for all your intelligence work.

The biggest advantage of a dedicated suite is its ability to connect the dots between different data points to reveal larger trends.

Common Features of CI Suites

- Automated Battlecards: Get quick, digestible summaries of key competitors—including their strengths, weaknesses, and recent moves—that are incredibly useful for sales teams.

- Real-Time Alerts: Get notified the moment a competitor launches a new ad campaign, gets a mention in the news, or makes a big change to their website.

- Market Trend Analysis: These tools often include features for tracking broader industry shifts, helping you see beyond direct competitors to understand the bigger picture.

By pulling everything together, these platforms help you move from simply collecting data points to building a comprehensive, actionable understanding of your competitive landscape.

How Social Listening Supercharges Your CI

Traditional competitive intelligence often feels like trying to understand a company by reading its perfectly polished annual report. You get the official story, but you miss all the candid, unfiltered conversations happening every single day.

Traditional competitive intelligence often feels like trying to understand a company by reading its perfectly polished annual report. You get the official story, but you miss all the candid, unfiltered conversations happening every single day.

This is where social listening completely changes the game.

Imagine having a direct line into the world’s largest, most honest focus group—one that’s always on, discussing your competitors, their products, and your industry. That's what social listening brings to your CI strategy. It’s the difference between hearing a press release and overhearing a crucial conversation in the company cafeteria.

Instead of waiting for quarterly reports, you get a live stream of public sentiment. This real-time feedback loop lets you be incredibly proactive, spotting trends, threats, and opportunities as they pop up—not weeks or months later.

Uncover Unfiltered Customer Pain Points

One of the biggest wins from social listening is finding out what truly frustrates your competitors' customers. A company's official support channel might handle individual complaints, but public forums and social media are where patterns of dissatisfaction really come to light.

People go online to vent about bugs, complain about bad service, or ask for features that are missing. By tuning into these conversations, you can identify major gaps in what your competitor is offering.

- For example: A software company might notice a growing number of users on Reddit complaining that a rival’s new update is slow and clunky. This is a direct signal to highlight your own product's speed and reliability in your next marketing campaign.

This kind of intelligence is pure gold. It tells you exactly where to focus your product development and how to position your solution as the obvious answer to a known problem.

Social listening transforms competitive intelligence from a rearview mirror into a forward-looking radar. It helps you anticipate market shifts and competitor weaknesses by tapping into the authentic voice of the customer.

By tracking these discussions, you build a detailed map of your competitor's weaknesses, straight from the people who experience them firsthand. This data gives your sales team specific talking points and helps your product team prioritize features that will win over unhappy users.

Track Campaigns and Product Launches in Real Time

When a competitor drops a new product or a big marketing campaign, traditional analysis can take days to figure out the impact. With social listening, you can watch the public reaction unfold minute by minute.

This immediate feedback gives you a real sense of how the market is responding, far beyond what press coverage or official announcements reveal.

You can instantly track key metrics like:

- Sentiment Analysis: Are people excited, confused, or angry about the launch? Advanced tools can automatically sort mentions into positive, negative, or neutral buckets.

- Message Resonance: Which parts of their campaign are people sharing and talking about most? This helps you understand what actually connects with your target audience.

- Key Influencers: Who are the key voices discussing the launch? Finding these people can inform your own influencer marketing and PR strategies.

This real-time view allows you to react with incredible speed. If a competitor’s campaign is falling flat, you can quickly launch a counter-campaign that hits the exact points they missed. Or, if their launch is a massive success, you can analyze what worked so well and apply those lessons to your own playbook.

Identify Emerging Threats and Opportunities

The digital world moves fast, and social listening acts as your early warning system. It helps you spot potential PR crises for your competitors before they become major headlines. A sudden spike in negative mentions or a viral complaint can signal a brewing issue, giving you time to prepare. You can learn more about this proactive approach in our guide to social media reputation monitoring.

On top of that, social listening is a powerful tool for finding "white space" opportunities. By analyzing broad industry conversations, you might discover unmet needs or emerging trends that nobody is addressing yet. These are the kinds of conversations that can lead to your next big product innovation or a winning market position.

Building Your Competitive Intelligence Process

Good competitive intelligence isn’t a one-and-done project. It’s a living, breathing system you build inside your organization. Think of it like a chef in a busy kitchen—they don't just cook one amazing meal and call it a day. They rely on a well-organized setup and repeatable processes to create incredible dishes consistently. Your business needs the same structured approach to turn raw market data into strategic gold.

The goal is to pull competitive intelligence out of a forgotten silo and make it the heartbeat of your company. When you get it right, it continuously feeds game-changing insights to sales, marketing, and product teams, creating a culture of curiosity and market awareness.

Defining Your Key Intelligence Questions

Before you can find any answers, you have to know what you’re asking. This all starts with defining your Key Intelligence Questions (KIQs). These are the big-picture, strategic questions that your business absolutely needs answers to, and they should tie directly back to your most important company goals.

Think of KIQs as the guiding star for all your intelligence work. They keep your team from drowning in a sea of irrelevant data and make sure every piece of information you gather actually serves a purpose.

Examples of Strong KIQs:

- How are our top three competitors positioning their new AI features against ours?

- What customer pain points keep popping up in online forums that our competitors are failing to address?

- Which new companies are starting to get noticed in our market, and what makes them different?

- What pricing or packaging experiments are our competitors running that could steal our market share?

These questions are specific, actionable, and built to drive decisions, not just to collect random facts.

A well-defined KIQ is your filter for all the noise out there. It turns a vague goal like "know the competition" into a focused mission to find specific, powerful insights that help the business grow.

Structuring Your CI Function and Cadence

With your KIQs locked in, the next step is building the framework to get them answered. This doesn’t mean you need to go out and hire a massive team. Your structure could be as simple as one dedicated analyst or a cross-functional team with people from different departments chipping in.

The most important thing is clear ownership. Someone has to be responsible for driving the process, from collecting the data to analyzing it and sharing the findings. This is becoming a more formal role in many businesses for a reason. In fact, competitive intelligence teams are growing, with research showing team sizes have increased by about 24% in recent years as more companies catch on to its importance. You can dig into the full research on CI trends and team growth to see how the industry is shifting.

Once you have an owner, set up a regular rhythm for reporting. This cadence makes sure insights are delivered consistently and don't get buried under daily tasks. A good rhythm might look something like this:

- Daily or Weekly Alerts: Automated pings on critical competitor moves, like price changes or big press announcements.

- Monthly Intelligence Briefings: A tidy summary of key trends, competitor moves, and emerging threats for department heads.

- Quarterly Strategic Reviews: A deep-dive analysis for the leadership team to help shape long-term plans and spot opportunities to pivot.

This kind of structured rhythm turns competitive intelligence gathering from an occasional fire drill into a reliable, predictable source of strategic advantage that’s baked right into your company’s planning cycle.

Turning Intelligence into Strategic Action

Gathering competitive intelligence is only half the battle. If you don't act on what you learn, it’s like a sports team scouting an opponent only to ignore the game plan on game day. All that hard work collecting and analyzing data goes to waste if it doesn't lead to smarter, more decisive business moves.This is the moment of truth. The final, most critical step in competitive intelligence gathering is translating those hard-won insights into real, tangible action. It’s the bridge between knowing something important about the market and doing something powerful with that knowledge. Without this crucial step, your intelligence just becomes an academic exercise, collecting dust in a report somewhere.

Adopting an Insight-to-Action Framework

To make sure your intelligence actually gets used, you need a simple but effective framework. Think of it as a model that helps you connect the dots from a specific insight to a concrete business initiative, ensuring nothing gets lost in translation.

The goal here is to create a repeatable process your teams can fall back on. This system helps drive growth, defend your market position, and gives your entire CI program a clear return on investment.

Intelligence isn't about collecting data just for the sake of it. It’s about arming your organization with the foresight to outmaneuver competitors, delight customers, and drive sustainable growth through informed action.

This process boils down to asking a few direct questions whenever a new piece of intelligence surfaces. It's how you shift from being a passive observer to an active strategist.

Putting the Framework into Practice

Let’s walk through a few real-world scenarios to see how this works. Each one starts with a raw piece of intelligence and ends with a specific, measurable action that gives the business a competitive edge.

Insight: Social listening uncovers a wave of complaints about a top competitor's confusing new pricing tiers. Customers are frustrated and openly looking for simpler alternatives.

Action: Your marketing team quickly launches a targeted ad campaign highlighting your company's transparent, straightforward pricing. Sales reps get new talking points to address this specific pain point with prospects.

Insight: You notice a rival is hiring a whole team of engineers with expertise in an AI technology your product doesn't have yet.

Action: Your product team immediately re-prioritizes the roadmap, accelerating the development of a similar feature to close the gap before the competitor can pull too far ahead.

Insight: A competitor’s key marketing executive announces their departure on LinkedIn, and their team sounds uncertain in the comments.

Action: The sales team kicks off a focused outreach campaign targeting the competitor's key accounts, using the potential disruption to win over clients who might be feeling a bit unsettled.

From Insight to Actionable Strategy

This table offers a clear framework for converting competitive insights into specific business actions. It helps structure your thinking so you can respond quickly and effectively to market shifts.

| Competitive Insight | Potential Business Risk/Opportunity | Strategic Action |

|---|---|---|

| Competitor lowers prices on a core product by 15%. | Risk: Potential loss of price-sensitive customers. | Launch a value-focused campaign emphasizing total cost of ownership and superior support. |

| A new startup gets traction with a niche feature. | Opportunity: Acquire the startup or build a better version of the feature. | Assign the product team to evaluate the feature's potential and draft a development plan. |

| Negative reviews about a rival's customer service surge. | Opportunity: Position your brand as the superior service leader. | Create case studies and testimonials that focus on your award-winning customer support. |

By consistently applying this framework, you ensure that every piece of intelligence you gather has the potential to become a strategic advantage. It’s how you turn information into impact.

Common Questions About Competitive Intelligence

Diving into competitive intelligence often brings up a few big questions, especially around doing things the right way and proving it's all worth the effort. Getting clear answers from the start helps you build a solid, effective CI program. Let's tackle the ones we hear most often.

Is Competitive Intelligence Gathering Ethical?

Absolutely—as long as you’re doing it right. Ethical competitive intelligence is all about using publicly available and legally obtained information. Think of yourself as a great detective, not a spy.

The line gets crossed when people use shady methods like deception, trying to steal trade secrets, or accessing private information. Ethical CI means you’re not misrepresenting who you are to a competitor or trying to hack their systems. When you stick to public sources, your program stays both effective and reputable.

The core idea of ethical CI is simple: be transparent and legal. It’s about outsmarting the competition with better analysis of public data, not by breaking rules or trust.

How Do You Measure The ROI of CI?

Measuring the return on investment (ROI) for competitive intelligence might seem fuzzy at first, but it's completely doable when you connect your insights to actual business results. The key is to track how a piece of intelligence led to a specific action, and what that action accomplished.

For example, did an insight about a competitor's product weakness inspire a marketing campaign that bumped up your sales win rate by 10%? That’s a real, measurable impact.

You can track ROI with metrics like:

- Higher Sales Win Rates: Attribute specific wins to competitive insights the sales team used.

- Improved Market Share: Connect strategic changes you made based on CI to gains in your market position.

- Cost Savings: Calculate the money you saved by not making a strategic mistake you saw a competitor make.

By drawing a straight line from intelligence to these key performance indicators, you can clearly show the financial value your competitive intelligence gathering brings to the business. This makes it much easier to justify the budget and resources you need.

Ready to turn social conversations into your biggest competitive advantage? Intently monitors millions of online discussions to find high-intent leads and crucial market insights for your team. Start uncovering opportunities your competitors are missing by visiting https://intently.ai.