10 Powerful Competitor Analysis Techniques for 2025

In today's hyper-competitive market, a casual glance at what your rivals are doing is a recipe for being left behind. To genuinely innovate, capture market share, and build a lasting brand, you need a systematic approach for dissecting their strategies, strengths, and vulnerabilities. True competitive intelligence isn't about imitation; it's about gaining a strategic advantage through deep understanding.

This guide moves beyond simple observation and provides a comprehensive toolkit of ten powerful competitor analysis techniques. We will unpack everything from foundational frameworks like SWOT and Porter's Five Forces to modern, data-driven methods like digital footprint analysis and customer journey mapping. Each technique is presented as a practical, step-by-step process designed to turn raw competitive data into actionable business strategy.

Whether you are a solopreneur hunting for high-intent leads, a marketing team refining its messaging, or a product manager building a feature roadmap, mastering these methods is critical. You will learn not just what your competitors are doing, but why they are doing it and, most importantly, where their blind spots are. This knowledge is your key to identifying untapped opportunities and making smarter, faster decisions. By implementing these structured frameworks, you can stop reacting to the market and start shaping it. Let's dive into the techniques that will give you the clarity needed to not just compete, but to lead.

1. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

A cornerstone of strategic planning, SWOT analysis is one of the most foundational competitor analysis techniques available. It provides a structured framework for evaluating a competitor by examining four key areas: their internal Strengths and Weaknesses, and the external Opportunities and Threats they face in the market. This dual focus on internal capabilities and external market forces delivers a holistic view of a competitor's strategic position.

By systematically mapping these four quadrants, you can pinpoint exactly where a rival excels, where they are vulnerable, and how market dynamics might impact their future performance. This clarity allows you to identify potential competitive advantages for your own business and uncover untapped market gaps.

How to Implement a Competitor SWOT Analysis

Applying this framework is straightforward. Create a four-quadrant grid and populate it with data-backed insights about a specific competitor. For example, Netflix might have analyzed Disney+ by listing its vast, family-friendly content library as a Strength but its later entry into the streaming market as a Weakness. The growing global demand for streaming content would be an Opportunity, while increasing content production costs and regulatory hurdles represent Threats.

Actionable Tips for Effective SWOT Analysis

To get the most out of this technique, move beyond simple lists and turn your analysis into a strategic tool.

- Use Cross-Functional Teams: Involve members from sales, marketing, product, and customer support to gather diverse perspectives and reduce individual bias. A salesperson might have unique insights into a competitor's aggressive pricing (Weakness), while a support agent may know about their poor customer service (Weakness).

- Prioritize with Data: Don't just list points; support each one with evidence like market share reports, customer reviews, or financial statements. Use a simple scoring system (e.g., 1-5 scale) to rank the impact of each item, helping you focus on what truly matters.

- Convert Insights to Action: The goal isn't the document itself but the actions it inspires. For every identified competitor weakness, create a corresponding action item. If a competitor has slow delivery times, your action might be to launch a marketing campaign highlighting your own company's next-day shipping.

2. Porter's Five Forces Analysis

Developed by Harvard Business School professor Michael E. Porter, this framework is a powerful tool for understanding the underlying competitive structure of an entire industry. Rather than focusing on a single competitor, Porter's Five Forces analyzes the broader landscape to determine its attractiveness and profitability. It examines five key forces: the Threat of New Entrants, the Bargaining Power of Suppliers, the Bargaining Power of Buyers, the Threat of Substitute Products, and the Rivalry Among Existing Competitors.

By evaluating these structural forces, you can move beyond surface-level observations to grasp why an industry is profitable (or not) and where strategic advantages can be found. This macro-view is one of the most effective competitor analysis techniques for assessing long-term strategic positioning and identifying systemic risks or opportunities that affect all players.

How to Implement Porter's Five Forces Analysis

Application involves systematically assessing the intensity of each of the five forces within your industry. For example, a company like Uber, when evaluating the taxi industry, would have identified a high Threat of New Entrants due to low regulatory barriers in many cities and a low Bargaining Power of Buyers (riders) who previously had few alternatives. This analysis would have revealed a structurally vulnerable industry ripe for disruption.

Similarly, airlines consistently use this model to understand why their industry suffers from low profitability. Intense Rivalry Among Existing Competitors, high Bargaining Power of Suppliers (aircraft manufacturers like Boeing and Airbus), and a significant Threat of Substitutes (cars, trains) all combine to squeeze profit margins.

Actionable Tips for Effective Five Forces Analysis

To make this framework a dynamic part of your strategy, go beyond a simple assessment and apply these targeted tips.

- Quantify and Prioritize: Assess each force on a scale (e.g., low, medium, high) and list the specific factors supporting your rating. For "Threat of New Entrants," factors could include capital requirements, brand loyalty, and government policy. This helps you focus on the most influential forces.

- Analyze Digital Disruption: Consider how technology is reshaping traditional industry dynamics. E-commerce has dramatically increased the Bargaining Power of Buyers in retail, while software-as-a-service (SaaS) models have lowered the Threat of New Entrants in many software categories.

- Combine with PESTEL Analysis: For a complete external assessment, pair the Five Forces with a PESTEL (Political, Economic, Social, Technological, Environmental, Legal) analysis. This ensures you account for both industry-specific and macro-environmental factors that could impact your competitive landscape.

3. Competitive Benchmarking

Competitive benchmarking is the systematic process of measuring and comparing your company's products, services, processes, and performance metrics against industry leaders and direct competitors. This technique moves beyond qualitative assessments to provide quantifiable data on where you stand, helping to identify performance gaps, establish realistic goals, and uncover best practices that drive success.

Pioneered by Xerox in the late 1970s, this method provides an objective, data-driven baseline for excellence. By analyzing how top performers achieve their results in areas like cost, quality, and customer satisfaction, you can reverse-engineer their success and adapt their strategies to fit your own business, making it one of the most powerful competitor analysis techniques for operational improvement.

How to Implement Competitive Benchmarking

The core of this technique is data collection and comparison. You first identify key performance indicators (KPIs) that are critical to your success, such as customer acquisition cost, production cycle time, or net promoter score. Then, you gather data on these same metrics for your chosen competitors through public reports, industry studies, customer surveys, or even mystery shopping.

For instance, Samsung has historically benchmarked Apple's retail experience and customer satisfaction scores to inform and enhance its own store strategy. Similarly, Toyota famously benchmarked Ford's mass-production assembly lines, leading to the development of its own revolutionary Toyota Production System.

Actionable Tips for Effective Benchmarking

To ensure your benchmarking efforts lead to meaningful change, follow these strategic guidelines.

- Focus on Value-Driving Metrics: Don't get lost in vanity metrics. Concentrate on benchmarking KPIs that directly impact customer value and business outcomes, such as delivery speed, product reliability, or post-purchase support quality.

- Look Beyond Your Industry: For true innovation, benchmark against best-in-class companies outside your direct industry. A classic example is Xerox studying L.L. Bean’s warehousing and fulfillment processes to dramatically improve its own logistics.

- Understand the "How," Not Just the "What": The goal isn't just to identify performance gaps but to understand the underlying processes and strategies that create them. In addition to direct benchmarking, a structured comparable company analysis template can provide a powerful framework for evaluating competitors.

- Create a Continuous Process: Benchmarking should not be a one-time project. Establish dashboards to track key metrics over time, allowing you to monitor progress, spot emerging trends, and maintain a culture of continuous improvement.

4. Perceptual Mapping (Positioning Maps)

Perceptual mapping, also known as positioning mapping, is a powerful visual technique used to understand the competitive landscape from the customer's perspective. It plots competitor brands on a two-dimensional chart based on how consumers perceive them across key attributes. This strategic tool reveals how your brand is positioned relative to others, identifies crowded market segments, and highlights untapped "white space" opportunities.

By mapping perceptions rather than just objective features, this technique captures the reality of how customers make decisions. It translates complex market data into an intuitive visual format, making it one of the most effective competitor analysis techniques for clarifying brand strategy and identifying differentiation opportunities.

How to Implement Perceptual Mapping

To create a positioning map, you first select two key attributes that drive customer choice in your industry, such as price and quality, or innovation and affordability. You then plot your competitors (and your own brand) on the map based on survey data, customer reviews, or market research. For example, automobile brands are often mapped on axes of Price (Economy vs. Luxury) and Performance (Practical vs. Sporty), clearly showing the distinct positions of brands like Toyota, BMW, and Ferrari.

Actionable Tips for Effective Perceptual Mapping

To transform a simple chart into a strategic guide, apply these focused tips.

- Choose Meaningful Axes: Select attributes that are genuine purchase drivers for your target audience, not just internal metrics. Use customer surveys or focus groups to identify what truly matters to them, ensuring your map reflects market reality.

- Use Objective Data: Base your map on quantitative data from surveys or conjoint analysis rather than internal assumptions. This prevents bias and provides a true picture of market perceptions. Include your own brand's position from both an internal (how you see yourself) and external (how customers see you) perspective to spot discrepancies.

- Visualize Market Share: Enhance your map by using bubble sizes to represent each competitor's market share or revenue. This adds another layer of insight, quickly showing which positions are currently dominating the market and which are niche.

- Map Your Ideal Position: Plot where your brand currently is and where you want it to be. This visual gap analysis creates a clear strategic goal and helps align your marketing, product, and branding efforts toward closing that gap.

5. Social Media and Digital Footprint Analysis

This modern competitor analysis technique involves monitoring and analyzing a competitor's entire digital presence across social media platforms, websites, blogs, and online forums. It provides a real-time pulse on their engagement metrics, content strategy, audience sentiment, and digital marketing tactics. By tapping into this wealth of public data, you gain immediate insights into their marketing activities, customer perception, and emerging market trends.

This approach allows you to see how competitors are positioning their brand, what messages resonate with their audience, and how they handle customer interactions. For instance, a SaaS company can track a competitor’s LinkedIn content to see which topics drive the most engagement, while a beauty brand can analyze a rival's influencer partnerships on Instagram to inform its own collaborations.

How to Implement a Digital Footprint Analysis

Start by identifying your competitors' key online channels: their primary social media accounts (like Twitter, LinkedIn, Instagram, TikTok), corporate blog, and any third-party forums where they are active. Systematically track their content types, posting frequency, engagement rates, and the tone of audience comments. To gain a significant advantage in the online realm and inform your digital strategy, it is essential to conduct a comprehensive SEO competitor analysis as part of this process. This will reveal their keyword strategy and search performance, adding another layer to your analysis.

Actionable Tips for Effective Digital Footprint Analysis

To extract meaningful intelligence, go beyond surface-level observation and adopt a structured approach.

- Utilize Social Listening Tools: Automate the data collection process using platforms like Hootsuite, Brandwatch, or Sprout Social. Set up alerts for competitor brand names, key products, and campaign hashtags to capture conversations as they happen.

- Focus on Engagement, Not Vanity Metrics: A large follower count can be misleading. Analyze the engagement rate (likes, comments, shares relative to follower size) to understand how much of their audience is truly captivated by their content.

- Analyze Audience Sentiment: Don't just count mentions; categorize them as positive, negative, or neutral. This helps you identify recurring customer complaints about a competitor that you can solve or common praises you can emulate. You can learn more about effective social media reputation monitoring to refine this process.

6. Win-Loss Analysis

One of the most direct competitor analysis techniques, win-loss analysis is a systematic process for understanding why you win business and, more importantly, why you lose it to competitors. By conducting structured interviews with recent buyers (both won and lost), this method goes straight to the source to uncover the real factors driving purchasing decisions, moving beyond internal assumptions and sales team anecdotes.

This technique provides unfiltered feedback on your pricing, product features, sales process, and brand perception relative to your rivals. It captures the authentic voice of the customer, revealing the criteria they truly value and how your competitors are positioned in their minds. Armed with this knowledge, you can address specific weaknesses, double down on proven strengths, and refine your go-to-market strategy with precision.

How to Implement a Win-Loss Analysis

The core of this technique is the post-decision interview. For example, Salesforce might conduct win-loss interviews to understand why a mid-market company chose HubSpot over its own CRM. By speaking directly with the decision-maker, they could discover that HubSpot's onboarding process and transparent pricing were the key differentiators. This insight could then inform changes to Salesforce's own product marketing and sales strategy for that segment. Similarly, Slack could interview companies that chose Microsoft Teams to pinpoint specific enterprise security features that need improvement.

Actionable Tips for Effective Win-Loss Analysis

To transform this feedback into a competitive advantage, structure your process for clarity and consistency.

- Act Quickly and Use a Third Party: Conduct interviews within 30-60 days of the decision while memories are still fresh. Using a neutral third-party interviewer often yields more candid and honest responses, as prospects are more comfortable sharing direct criticism with an unbiased party.

- Focus on Open-Ended Questions: Instead of asking "Was our price too high?", ask "What role did budget play in your evaluation process?" This encourages detailed stories about their decision journey, evaluation criteria, and the alternatives they seriously considered.

- Systematize and Share Insights: Aim for a consistent volume, such as interviewing 10-15 wins and losses per quarter, to identify reliable patterns. The real value is realized when these insights are shared across product, marketing, and sales teams to drive meaningful, cross-functional change.

7. Feature and Product Comparison Matrix

A Feature and Product Comparison Matrix is a structured framework that systematically compares your product features against those of your competitors. This technique creates a side-by-side visual grid, evaluating products across relevant attributes, capabilities, and specifications. It is particularly valuable in markets where specific features are a primary purchase driver, such as B2B SaaS or consumer electronics.

By laying out this data in an easy-to-digest format, you can immediately spot competitive advantages, identify feature gaps in your own offering, and pinpoint clear areas for differentiation. This clarity is essential for guiding product development roadmaps, arming sales teams with effective "battle cards," and crafting marketing messages that highlight your unique value proposition.

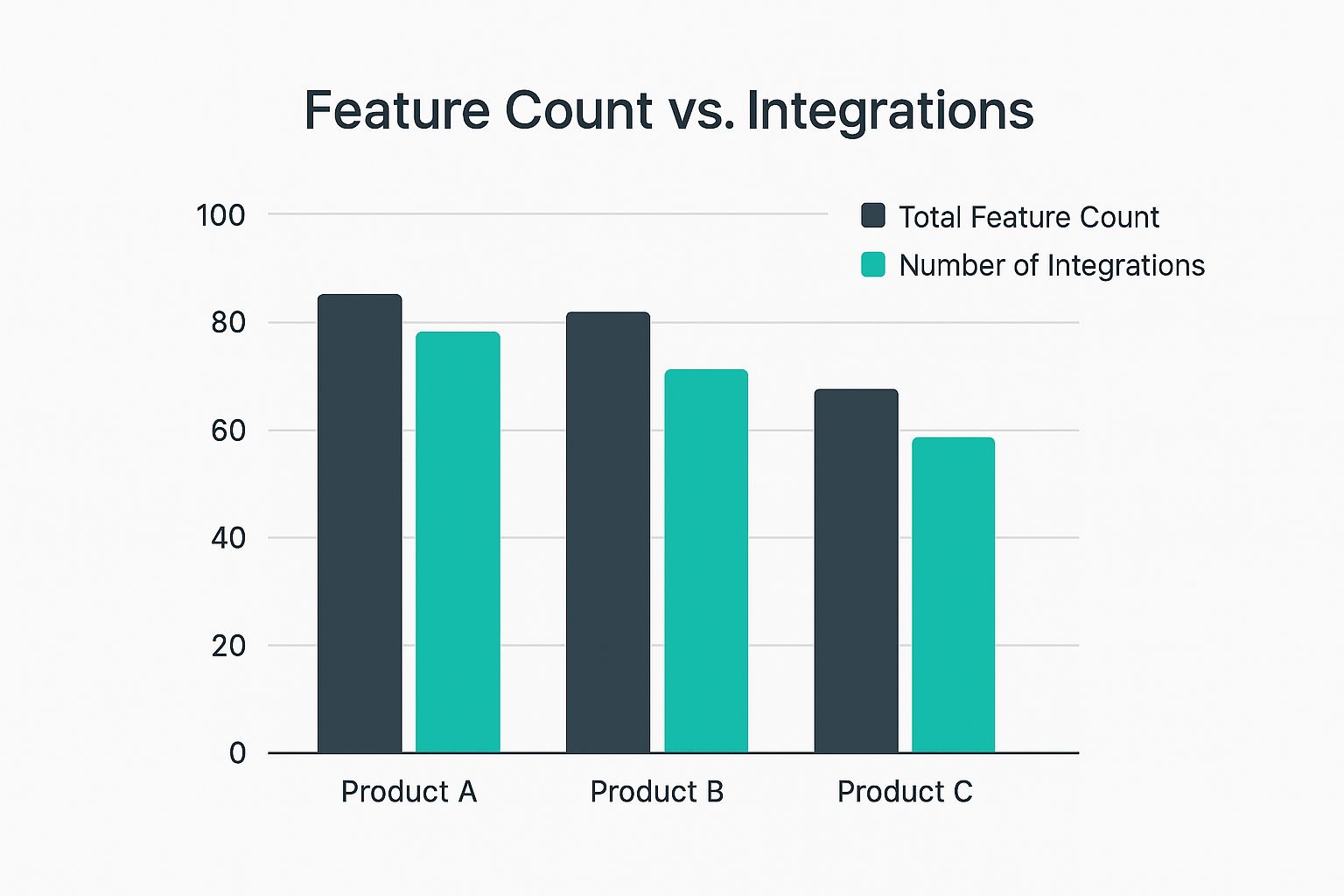

This bar chart visualizes a simplified feature comparison, assessing the total feature count and number of integrations for three competing products.

The chart reveals that while Product B leads in the total number of features, Product C holds a significant advantage in its integration capabilities.

How to Implement a Feature and Product Comparison Matrix

To apply this technique, create a spreadsheet or table listing key features and attributes down the first column and your competitors along the top row. Then, populate the grid with your findings. For instance, CRM vendors might create a matrix comparing Salesforce, HubSpot, and Pipedrive on capabilities like lead scoring, email automation, and reporting dashboards, noting the depth and quality of each implementation.

Actionable Tips for Effective Feature Comparison

To transform your matrix from a simple checklist into a strategic asset, focus on adding depth and context.

- Prioritize Customer-Centric Features: Instead of listing every single feature, focus on those that customers actually value and base their purchasing decisions on. Use surveys, customer interviews, and support ticket data to identify these critical attributes.

- Go Beyond Binary Checkmarks: A simple "yes" or "no" is not enough. Use a rating scale (e.g., 1-5) or add qualitative notes to describe the quality, usability, and completeness of a competitor's feature implementation.

- Include Non-Product Factors: Differentiate your matrix by including columns for pricing models, customer support quality, available training resources, and the strength of their user community. These factors often play a crucial role in the customer's decision. Learn more about how these factors influence B2B lead generation.

8. Strategic Group Analysis

Not all competitors are created equal. Strategic group analysis is a powerful competitor analysis technique that moves beyond a simple company-versus-company view by mapping clusters of rivals who pursue similar strategies within an industry. Companies within the same strategic group compete most directly because they target similar customers, use comparable distribution channels, or focus on similar dimensions like price and quality.

This framework helps you visualize the competitive landscape, identify your closest rivals, and understand the "mobility barriers" that prevent companies from easily shifting from one strategic group to another. By mapping these groups, you can spot underserved market positions and assess the profitability and attractiveness of different competitive approaches.

How to Implement a Strategic Group Analysis

The process involves plotting competitors on a two-dimensional map. First, you must select key strategic dimensions that define the competitive structure of your industry. For example, in the airline industry, you might map carriers based on their geographic scope (national vs. international) and their service level (full-service vs. low-cost). This would reveal distinct groups like legacy carriers (Delta, United), low-cost carriers (Southwest), and ultra-low-cost carriers (Spirit, Frontier), each competing intensely within their own cluster.

Similarly, in retail banking, you could map institutions by their physical presence (branch-heavy vs. digital-only) and customer focus (mass-market vs. wealth management). This identifies groups like traditional banks, credit unions, and fintech neobanks.

Actionable Tips for Effective Strategic Group Analysis

To turn your map into a strategic weapon, focus on deriving meaningful insights.

- Choose Meaningful Dimensions: Select variables that reflect significant strategic choices, not just performance outcomes. Good examples include brand image, technology platform, or level of vertical integration. Avoid using metrics like market share or profitability as dimensions themselves.

- Analyze Group Profitability: Assess the financial performance of each strategic group. Are the low-cost, high-volume players more profitable than the high-touch, premium groups? This helps identify which strategic positions are most lucrative and defensible.

- Identify Mobility Barriers: Pinpoint the factors that make it difficult for a company to move from one group to another. These barriers, such as brand reputation, proprietary technology, or economies of scale, protect profitable groups from new entrants and are crucial for understanding competitive dynamics.

9. Market Share and Growth Analysis

A purely quantitative approach, this competitor analysis technique focuses on the hard numbers that define market dominance and momentum. It involves measuring and tracking competitors' market share, revenue growth rates, and market penetration to get a clear, data-driven picture of the competitive landscape. This analysis reveals who is leading, who is losing ground, and where the market is heading.

By tracking these key performance indicators over time, you can identify emerging threats, spot market consolidation trends, and understand the overall health of your industry. It moves beyond perception and opinion to provide an objective assessment of a competitor's performance and strategic position, making it an essential tool for strategic decision-making.

How to Implement Market Share and Growth Analysis

To apply this technique, gather quantitative data from industry reports (like Gartner or IDC), company financial statements, and market research firms. For example, in the cloud infrastructure market, an analysis would show AWS’s dominant but slowly declining market share as competitors like Microsoft Azure and Google Cloud exhibit faster growth rates. This signals an intensifying competitive environment and a shift in market dynamics.

Similarly, a smartphone manufacturer would track not just Apple's and Samsung's overall share, but also how their respective shares change quarter-over-quarter in specific regions or price segments. This granular view helps identify specific areas of competitive strength and weakness.

Actionable Tips for Effective Market Share Analysis

To ensure your analysis yields powerful insights, focus on depth and context rather than just topline numbers.

- Triangulate Your Data Sources: Never rely on a single report. Cross-reference data from financial filings, syndicated market research, and industry news to get a more accurate and reliable picture of market share.

- Segment for Deeper Insights: A competitor might have low overall market share but dominate a crucial niche. Segment your analysis by customer type, geographic region, or product line to uncover these hidden pockets of strength.

- Track Relative Market Share: Instead of just looking at absolute share, calculate your relative market share (your share divided by your largest competitor’s share). This metric, central to frameworks like the BCG Matrix, is a better indicator of your competitive strength.

- Analyze Growth Quality: A competitor’s growth might be fueled by aggressive, unprofitable discounting. Look at profitability metrics and customer acquisition costs alongside growth rates to assess whether their momentum is sustainable.

10. Customer Journey and Experience Mapping

While many competitor analysis techniques focus on products or marketing messages, this method shifts the focus to the most critical element: the customer. Customer journey mapping involves charting the end-to-end experience a customer has with your competitors, from their first point of awareness through to purchase, onboarding, and post-sale support. This provides invaluable, firsthand insight into their service quality, user experience (UX), and overall brand perception.

By literally walking in a competitor's customer's shoes, you can identify their moments of delight, points of friction, and critical service gaps. This goes far beyond a simple feature comparison, allowing you to understand the complete emotional and practical experience a rival offers, which is often where true competitive advantages are won or lost.

How to Implement Competitor Journey Mapping

To apply this technique, you become a customer. For example, a hotel chain might have its managers book a stay at a rival hotel to assess the entire process, from online booking and check-in to room quality and checkout. Similarly, a SaaS company might sign up for a competitor's free trial to meticulously document the onboarding flow, app usability, and customer support responsiveness.

The goal is to map every touchpoint and interaction. Zappos famously analyzed the cumbersome return processes of its competitors, identifying a major customer pain point. This insight led them to create their industry-leading, hassle-free return policy, which became a core pillar of their brand identity and a massive competitive differentiator.

Actionable Tips for Effective Journey Mapping

To turn this exercise into a strategic asset, focus on capturing detailed, qualitative data.

- Become a Real Customer: Whenever possible, purchase the competitor's product or service. This provides the most authentic insights into their sales funnel, payment process, delivery, and follow-up communications.

- Document Everything: Take screenshots of their website flow, photos of their packaging, and detailed notes on every interaction. Document your emotional response at each stage, noting moments of frustration, confusion, or satisfaction.

- Map Different Personas: The journey for a first-time buyer is different from that of a power user. Analyze the experience for multiple key customer segments to get a comprehensive view. This is crucial for understanding how competitors target different audiences, a key step in refining your own customer acquisition strategies.

Competitor Analysis Techniques Comparison

| Technique | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| SWOT Analysis | Low - simple framework, easy to use | Low - minimal data needed | Holistic competitor overview, strategic insights | Initial competitive assessment and strategic planning | Intuitive, cost-effective, actionable insights |

| Porter's Five Forces Analysis | Medium - requires industry data and analysis | Medium - time-intensive research | Industry structure understanding, positioning | Industry attractiveness and market entry decisions | Deep industry insight, identifies power sources |

| Competitive Benchmarking | Medium-High - ongoing data collection | High - competitor data often hard to get | Performance gaps, best practices identification | Performance improvement and operational excellence | Objective, data-driven, continuous improvement |

| Perceptual Mapping | Medium - needs quality customer perception data | Medium - requires market research | Visual positioning, market gap identification | Brand positioning and market differentiation | Customer-centric, reveals white spaces |

| Social Media & Digital Footprint Analysis | Medium - requires ongoing monitoring | Medium - uses many free/paid tools | Real-time competitive insights | Marketing strategy and digital competitive monitoring | Real-time data, sentiment & trends |

| Win-Loss Analysis | High - requires structured interviews | High - needs buy-in from buyers and sales | Buyer insights on decision factors | B2B sales strategy refinement and product positioning | Genuine buyer perspective, actionable feedback |

| Feature/Product Comparison Matrix | Low-Medium - structured data collection | Medium - data on features and specs | Clear feature gaps and competitive advantages | Product strategy and sales enablement | Objective, easy to update, sales support |

| Strategic Group Analysis | Medium - requires mapping and strategic insights | Medium - needs data on competitors’ strategies | Identifies closest competitors, strategic groups | Strategic positioning and competitive set definition | Simplifies complexity, reveals strategic moves |

| Market Share and Growth Analysis | Medium-High - quantitative with trend analysis | Medium-High - depends on data availability | Objective market position and momentum | Portfolio management and investment decisions | Numbers-based, identifies market trends |

| Customer Journey and Experience Mapping | High - intensive data gathering and analysis | High - requires direct observation and feedback | Identifies experience gaps and innovation opportunities | Service design and customer experience strategy | Empathy-driven insights, uncovers friction points |

From Analysis to Action: Integrating Competitive Insights into Your Strategy

Throughout this guide, we've explored ten powerful competitor analysis techniques, each offering a unique lens through which to view your market landscape. From the foundational SWOT Analysis to the tactical depth of a Feature Comparison Matrix, you now possess a comprehensive toolkit for dissecting, understanding, and anticipating your rivals' moves. However, the true mastery of competitive intelligence isn't found in simply executing these frameworks; it lies in the synthesis of their findings and the translation of raw data into decisive, strategic action.

The most common pitfall in competitive analysis is treating it as a one-time project. A SWOT analysis conducted last year is a historical document, not a strategic guide for today's market. The digital landscape shifts daily, new players emerge, and customer expectations evolve. Therefore, the ultimate takeaway is that these techniques are not isolated exercises but components of a continuous, living process. Your goal should be to embed this cycle of analysis, strategy, execution, and measurement into your organization's core operations.

Synthesizing Your Findings for a 360-Degree View

No single technique tells the whole story. The real power emerges when you layer the insights from multiple analyses to build a multi-dimensional picture of the competitive environment. Think of it as building a strategic mosaic where each piece adds crucial context and color.

- For Strategic Planning: Combine a high-level SWOT Analysis with Porter's Five Forces to understand your internal capabilities against the broader industry pressures. This helps you identify sustainable competitive advantages and long-term strategic direction.

- For Market Positioning: Use Perceptual Mapping to visualize where your brand currently sits in the minds of customers. Then, use insights from a Social Media and Digital Footprint Analysis to validate or challenge those perceptions with real-world sentiment data.

- For Product Development: A Feature Comparison Matrix provides the "what," but a Customer Journey and Experience Mapping of your competitor's users provides the "why." This combination reveals not just what features they have, but how customers interact with them, uncovering opportunities for superior user experience.

- For Sales Enablement: Equip your sales team with insights from a Win-Loss Analysis. This direct feedback from the front lines is invaluable for refining your value proposition and handling objections, turning competitive losses into future wins.

Creating a System for Continuous Intelligence

Transforming analysis from a reactive task into a proactive discipline requires a system. Don't let your hard-earned insights gather dust in a forgotten spreadsheet. Instead, build a process that makes competitive intelligence an ongoing conversation within your team.

- Assign Ownership: Designate a point person or a small team responsible for tracking key competitors and market signals.

- Schedule Regular Reviews: Set a recurring meeting (monthly or quarterly) to review findings, discuss shifts in the landscape, and adjust your strategy accordingly.

- Create a Centralized Hub: Use a shared document, dashboard, or project management tool to store all your competitive research. This makes the information accessible and prevents knowledge silos.

- Leverage Automation: Manually tracking every competitor mention, review, and content piece is impossible. Use tools to automate the monitoring of their digital footprint, freeing up your team to focus on analysis and strategy.

Mastering these competitor analysis techniques is about more than just keeping an eye on your rivals; it's about deeply understanding the market dynamics that shape your business. It’s about finding the unclaimed territory, anticipating customer needs before they are articulated, and building a resilient strategy that can withstand market shifts. By moving from isolated analysis to an integrated system of intelligence, you transform your organization from a passive observer into a proactive market leader, ready to seize opportunities and confidently navigate the path ahead.

Ready to automate the most time-consuming part of your competitive analysis? Intently monitors social media, forums, and Q&A sites to send you real-time alerts when potential customers discuss your competitors or the problems your business solves. Stop searching and start engaging with high-intent leads by visiting Intently to see how it works.