A Guide to Identifying Market Opportunities

Spotting a market opportunity is more than just having a good idea. It's the disciplined skill of finding unmet needs, spotting underserved corners of the market, or catching emerging trends your business can actually profit from. It’s a mix of big-picture thinking—like watching economic shifts—and getting granular by listening to what real people are talking about.

The best businesses don't wait for these openings to fall into their laps. They hunt for them.

The Art of Uncovering Market Opportunities

Finding a genuine opportunity isn't some magical "aha!" moment. It's a skill you build through sharp observation, solid analysis, and a deep curiosity about what people really want or need. Many entrepreneurs think great opportunities are rare, but they're often hiding in plain sight. They show up as common complaints on a forum, subtle changes in how people behave, or gaps left open by bigger, slower companies.

This guide isn't about abstract theories. We’re diving straight into the practical, real-world methods that successful companies use every single day. You'll learn how to systematically find potential for growth by looking in the right places and, just as importantly, knowing how to read the signals you find.

What This Guide Covers

We're going to walk through a multi-layered approach to spotting market opportunities. You won't just learn what to look for, but how to look for it.

We'll get into:

- Reading Macro Trends: How to turn high-level economic data and global shifts into smart business intelligence.

- Decoding Competitor Moves: Analyzing industry activity, like mergers and acquisitions, to see where the smart money is heading.

- Listening to Customers with AI: Using modern tools like Intently to tap into authentic online conversations and find unfiltered customer needs.

- Validating Your Ideas: Making sure an opportunity is real by checking market health, consumer spending power, and labor stats.

Core Methods for Identifying Market Opportunities

Before we go deep, it helps to see the big picture. Most businesses use a combination of three core methods to find their next move. Each one gives you a different lens to look through.

Here's a quick look at the primary approaches businesses use to find new market opportunities, what each method focuses on, and the potential growth it can unlock.

| Method | Primary Focus | Potential Outcome |

|---|---|---|

| Macroeconomic Analysis | High-level economic indicators, global trends, and policy changes. | Identifying emerging markets, predicting shifts in consumer demand, and timing market entry. |

| Competitive Intelligence | Competitor strategies, product launches, acquisitions, and customer reviews. | Finding gaps in the market, spotting underserved niches, and developing a stronger value proposition. |

| Customer Listening | Unsolicited feedback, online discussions, and social media conversations. | Discovering unmet needs, identifying product improvement ideas, and innovating based on real pain points. |

By mastering these methods, you shift from passively waiting for an opportunity to proactively creating one. This guide gives you the frameworks and tools you need to start finding them today.

Reading Macro Trends to Find Hidden Demand

It’s easy to tune out when you hear terms like "global growth projections" or "inflation rates." For most business owners, that stuff feels like it belongs on Wall Street, totally disconnected from the day-to-day grind.

But here’s the thing: ignoring these big-picture trends means you’re missing some of the most powerful signals for spotting new market opportunities. These high-level shifts are the undercurrents shaping everything from what your customers buy to how stable your supply chain is.

Learning to read them lets you anticipate where demand is headed long before your competitors even have a clue. It’s all about turning abstract numbers into a concrete strategy that gives you a serious head start.

Turning Global Data into Actionable Strategy

The real trick is connecting the dots between a headline and its real-world impact. For instance, a report on rising household incomes in Southeast Asia isn't just a boring statistic. It’s a bright, flashing sign that consumers there might soon have more cash for premium goods or new services.

Similarly, when a government announces a massive infrastructure spending plan, that creates a ripple effect. It could signal a future need for construction tech, logistics software, or even services for a growing local workforce. You have to look past the headline.

The International Monetary Fund's World Economic Outlook is a great place to start. They're projecting global economic growth at 3.0% this year, with a slight bump to 3.1% next year. That tells you where money is flowing and which markets are heating up, giving you a clue about where to allocate your resources.

Key Takeaway: Macro trends aren't just for economists; they're a roadmap for proactive leaders. By tracking global economic shifts, you can see which markets are gaining steam, which customer segments have more buying power, and where new needs are about to pop up.

Key Macroeconomic Indicators to Watch

You don't need an economics degree to track the signals that matter most. Just keeping an eye on a few core indicators can give you a massive amount of insight into emerging market opportunities.

Here are the essential trends to keep on your radar:

- GDP Growth Projections: This is the big one. It’s a top-level look at a country's economic health. A nation with steady GDP growth is fertile ground for expansion because it often means a growing middle class and more business investment.

- Inflation Rates: When inflation eases up, consumer confidence tends to climb, and people start spending again. That could be a great time to enter a new market. On the flip side, high inflation might create an opening for value-focused or cost-saving products.

- Foreign Direct Investment (FDI) Flows: Pay attention to where big international companies are putting their money. It’s a strong vote of confidence. A surge of FDI into a specific sector basically validates its potential for you.

- Interest Rate Changes: When central banks change interest rates, it directly impacts how much it costs for people and businesses to borrow money. Lower rates can fire up demand for big-ticket items and encourage companies to expand.

Monitoring these indicators helps you build a much smarter view of the global landscape, so you can stop being reactive. It lets you make strategic moves based on where the world economy is headed, not just where it’s been.

This kind of foresight becomes incredibly powerful when you pair it with a solid lead generation strategy. For a deeper look at that, check out our beginner's guide to B2B lead generation. When you understand both the big picture and the on-the-ground tactics, you're building a real engine for sustainable growth.

Decoding Competitor Moves and Industry Shifts

While big-picture economic trends give you a bird's-eye view, zooming in on your immediate industry offers a far more actionable set of clues. What your competitors are building, who they're buying, and where they're investing—it’s a goldmine. Every single move they make can point to an opportunity they've just spotted, or even more importantly, one they've completely overlooked.

Think of it like this: your rivals are already spending their own time and money on market research. By simply watching them, you get to benefit from their homework. The goal isn't to copy them, but to figure out the why behind their actions so you can find your own unique angle.

This is a crucial piece of the puzzle that so many businesses miss. They get so wrapped up in their own product roadmap that they fail to see the strategic chess game playing out right in front of them.

Following the Money with Mergers and Acquisitions

One of the loudest signals in any market is merger and acquisition (M&A) activity. When one company buys another, they’re basically planting a flag, declaring where they believe future growth is hiding. They are placing multi-million, sometimes billion-dollar, bets on a specific technology, market segment, or region.

Tracking this "smart money" is like getting a sneak peek into the industry's future. It tells you which niches are starting to consolidate, which new technologies are gaining serious momentum, and which markets are becoming strategic hotspots.

For example, if you see a sudden wave of acquisitions involving smaller AI-powered logistics companies, it’s a clear sign that major players think automation is the next big battleground in supply chain management. That insight could help you pivot your own product or even develop a counter-strategy to serve customers who might get left behind by all the consolidation.

Mergers and acquisitions trends offer a powerful window into corporate growth strategies. When you see a pattern of high-value deals, it's a sign that companies are making big, strategic bets rather than just small, incremental changes.

Recent data shows just how revealing M&A activity can be. A PwC report found that while the total number of global M&A deals fell by 9% not long ago, the value of those deals actually jumped by 15%. This points to a clear trend toward bigger, more strategic acquisitions. The report also highlighted regions like India and the Middle East, where deal volumes shot up by 18% and 13% respectively, signaling major economic momentum.

A Practical Framework for Tracking Industry Shifts

You don't need an expensive analyst team to start picking up on these signals. A simple, consistent process for monitoring your industry can give you a huge strategic advantage.

Here’s a straightforward way to get started:

- Set Up Alerts for Key Competitors: Use simple tools to get notified whenever your top competitors pop up in the news. Pay special attention to announcements about funding rounds, new partnerships, or key executive hires—these often come right before a major strategic shift.

- Monitor Industry Publications: Trade journals and niche industry blogs are often the first to report on emerging trends or M&A rumors. Make reading them a weekly habit. It’s one of the easiest ways to stay ahead of the curve.

- Analyze Product Launches and Updates: When a competitor launches a new feature, pick it apart. Ask yourself what customer problem they're trying to solve. More importantly, ask what problems they aren't solving. The gaps in their product are your opportunities.

Let's say you run a project management software company. You notice that your main rival just acquired a small firm that specializes in AI-driven budget forecasting. That move is a massive hint that they believe automated financial planning is the future of project management.

This one piece of intel opens up several different paths for you. You could double down on a different niche they're now likely ignoring, like team collaboration features. Or, you could develop your own AI forecasting tool that’s built for a specific, underserved segment they missed, like small creative agencies.

By decoding their move, you can make a smarter one of your own.

Hearing What Customers Really Want with AI

Let's be honest, traditional methods like surveys and focus groups have a big blind spot. You only get answers to the questions you already know to ask. But what if you could listen in on the raw, unfiltered conversations customers are having when they think no one’s watching? That’s where AI-powered social listening completely changes the game.

It flips the script from asking direct questions to analyzing authentic, unsolicited chatter happening right now on social media, forums, and review sites. This is where the real gold is.

This raw feed of conversation shows you what customers actually care about, often uncovering pain points they wouldn't even know how to articulate in a formal survey. By digging into these conversations at scale, you can spot emerging trends, get real-world validation for a new product idea, and even discover untapped markets before your competitors have a clue.

Tapping into the Global Conversation

Think about trying to manually read every relevant post on Reddit, X (formerly Twitter), or LinkedIn to find people who need what you sell. It’s an impossible task. That’s why tools like Intently exist—they do all the heavy lifting, scanning millions of public conversations 24/7. They're your digital ears, always tuned in to the signals that matter.

You can set up monitors to track things like:

- Competitor mentions: What are people complaining about? Where are they dropping the ball?

- Pain-point keywords: Phrases that signal someone is struggling with a problem you can solve.

- Feature requests: Ideas that pop up organically in communities related to your industry.

- Broader industry trends: What are the larger shifts in how people feel or what they want?

This whole approach turns the firehose of messy social data into a clean, actionable stream of insights. It’s about moving from pure guesswork to data-backed intuition.

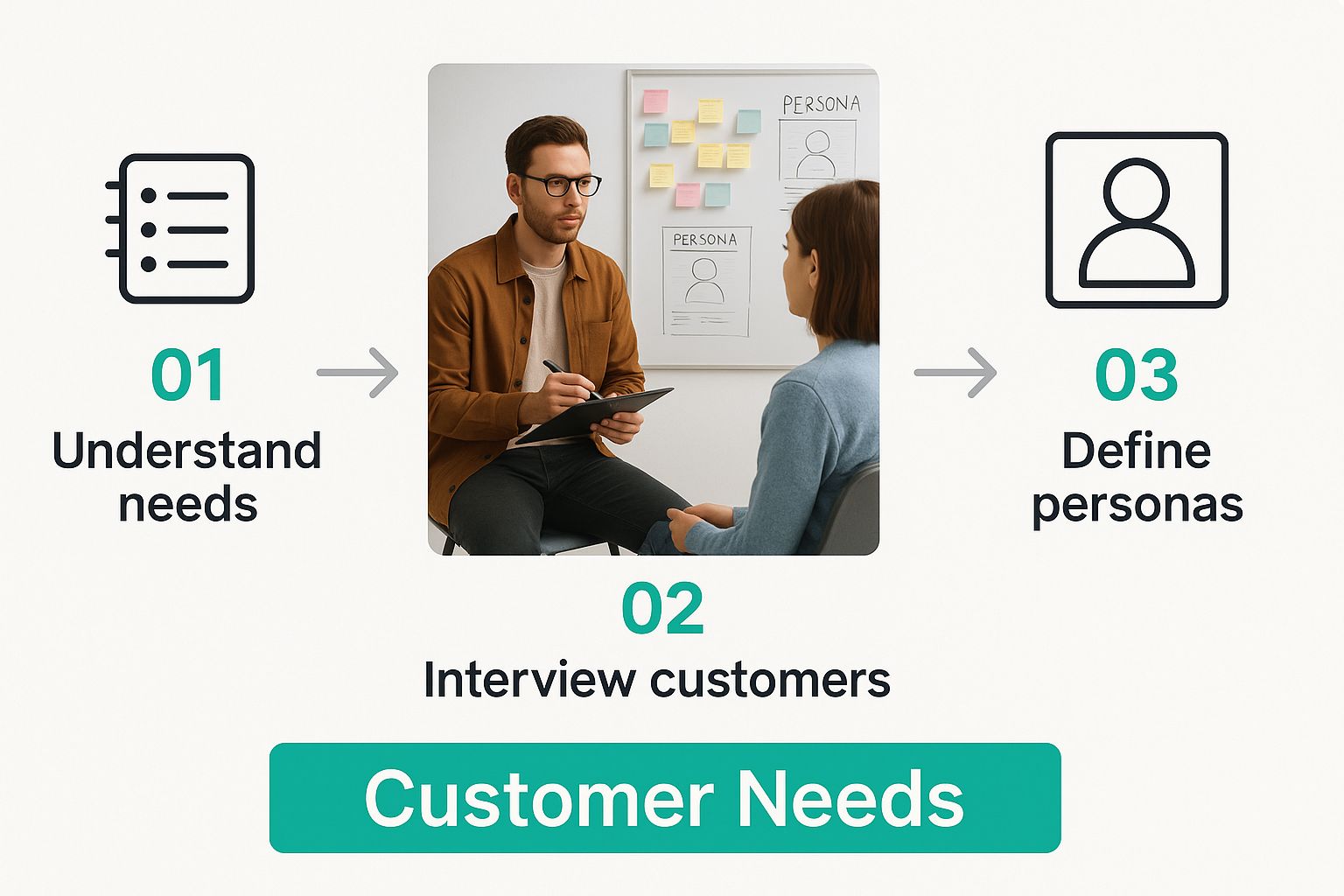

The infographic below really drives home how understanding customer needs through direct observation is the absolute foundation for finding a real market opportunity.

AI supercharges this process, basically letting you conduct thousands of these "customer interviews" online all at the same time.

From Social Chatter to Strategic Insights

Let's make this real. Imagine a company selling project management software. The market feels totally saturated. Instead of just guessing, they use social listening to monitor phrases like "hate using spreadsheets for projects" or "wish my PM tool could..."

Pretty quickly, a pattern emerges on a few marketing subreddits. Project managers at creative agencies are constantly griping about how hard it is to track client feedback on creative assets inside their current tools. They're stuck with messy email threads and disorganized spreadsheets—a huge, costly headache.

This is a classic market opportunity hiding in plain sight. It’s not some brand-new invention, but a very specific, high-value problem that a well-funded group of customers is desperate to solve. And the big players have completely missed it.

That single insight, pulled straight from social chatter, gives the company a clear path forward. Instead of building another generic PM tool, they can develop a feature—or maybe even a whole new product—just for creative agencies to handle client feedback.

Finding Leads and Opportunities Simultaneously

Here’s the best part: this method doesn't just give you market research; it fills your sales pipeline at the same time. The very same conversations that reveal an unmet need are often posted by people who are ready to buy a solution right now.

When you spot someone complaining about a competitor's missing feature, you've found both a gap in the market and a red-hot lead.

This dual benefit is what makes AI-powered social listening so incredibly efficient. You’re not just gathering data for a report that will collect dust on a shelf. You’re actively finding customers and validating your market fit in real-time. For a closer look at how this works on the sales side, check out our complete guide to AI lead generation tools.

By making this a core part of your process, you create a powerful feedback loop. Real customer conversations shape your product strategy, and your better product more effectively serves the new customers you find through those same channels.

Validating Opportunities with Market Viability

So, you've done the big-picture analysis. You’ve sized up the competition, spotted a promising gap in the market, and an exciting idea is starting to take shape.

Hold on. Before you spend a single dollar or a minute of development time, you have to answer the most important question of all: is this opportunity actually viable?

This is the validation stage. It’s where a brilliant idea gets stress-tested against the hard reality of economics. An opportunity is only real if your target audience has both the willingness and—more importantly—the ability to pay. This is where we stop observing problems and start confirming purchasing power.

Tying Labor Markets to Consumer Spending

Economic data about labor markets isn't just for stuffy reports; it's a goldmine for spotting real market opportunities. Metrics like unemployment rates and wage growth are direct signals of a market's health and its capacity to spend. They tell a clear story about the financial stability of your potential customers.

Think of it this way: a country with consistently low unemployment and rising wages is fertile ground. People in that environment are more likely to have disposable income, making them open to premium products, new services, and things they don't strictly need. Their financial confidence translates directly into your market potential.

On the flip side, a market with stubbornly high unemployment or stagnant wages signals a different kind of opportunity. Here, consumers are probably going to be extremely price-sensitive. This environment could be perfect for value-focused services, budget-friendly alternatives, or products that offer clear cost savings.

Key Takeaway: Labor market stats aren't just abstract figures. They are a direct proxy for consumer spending power. Use them to make sure your product’s value lines up with the economic reality of your target audience.

Using Economic Data to Confirm Your Target Audience

Understanding these dynamics is critical. Right now, global labor markets show some stark contrasts. The OECD records a stable unemployment rate of around 4.9% in higher-income countries. Meanwhile, Mexico is sitting at a low 2.6%, while South Africa is grappling with a rate over 32%.

These numbers aren't just trivia. They tell you about consumer spending power and what you might expect to pay for labor. For a deeper look at how this impacts market entry, the World Economic Forum’s research is a great resource.

Let’s make this real. Imagine you've identified a need for high-end, sustainable home goods. Validating this idea means looking for markets where:

- Wage growth is positive and steady. This tells you household incomes are rising, creating room for discretionary spending.

- Unemployment is low. This signals economic stability and consumer confidence—both necessary for people to invest in premium items.

- The cost of living isn't outpacing wage increases. This ensures that rising salaries actually translate into purchasing power, not just covering the basics.

This simple validation process helps you focus your energy on geographic areas or demographic groups that actually have the financial means to become your customers. It's a straightforward but powerful way to de-risk your strategy before you launch.

From Validation to Actionable Leads

Once you’ve confirmed a market has the economic muscle to support your idea, the next logical step is finding the actual people who are actively looking for a solution. This is where market viability connects directly to lead generation.

Knowing a market is healthy is one thing; finding the individuals ready to buy is another. This is where modern tools can bridge that gap.

For example, our platform helps you find high-intent conversations happening online right now, letting you connect with potential buyers in these validated markets. If you want to understand more about taking this next step, our guide on what is AI lead generation offers a deeper dive into turning market insights into real sales opportunities.

Combining strong market validation with precise, AI-driven outreach is a powerful formula for growth.

Common Questions About Market Opportunities

Once you start putting these strategies into practice, a few common questions always seem to pop up. Think of identifying market opportunities as an ongoing discipline, not a one-time project. Let's dig into some of the most frequent questions I hear, so you can move forward with confidence and sidestep the usual pitfalls.

How Often Should I Look for Market Opportunities?

Treating this like a one-and-done task is a huge mistake. The market is always shifting, and your approach to watching it needs to be just as dynamic. The best way to do this is to build the process right into your regular business rhythm, making it a habit instead of a massive, infrequent project.

For most businesses, a two-tiered approach works best:

- Quarterly Check-Ins: Every quarter, set aside some time for a light review of market trends, competitor news, and social conversations. This keeps you nimble and aware of short-term shifts without getting bogged down. It’s your chance to spot minor course corrections or emerging chatter before it blows up into a major trend.

- Annual Deep-Dive: Once a year, schedule a much more comprehensive analysis. This is when you step back and reassess your core strategy, run a deeper competitive analysis, and pinpoint the bigger, more strategic opportunities that could define your roadmap for the next 12-18 months.

Consistency is so much more valuable than intensity here. A steady pulse on the market will always beat a frantic, once-a-year scramble to play catch-up.

What Are the Biggest Mistakes to Avoid?

Spotting a new opportunity is exciting, but that excitement can lead to some pretty critical errors in judgment. Just knowing the common traps is the first step to avoiding them. One of the biggest mistakes is simply falling in love with an idea before it’s been properly validated.

This single mistake often triggers a cascade of other problems:

- Relying on Assumptions: The number one reason ventures fail is because the founders relied on their gut feelings without backing them up with real-world data. Your personal experience is valuable, sure, but it's not a substitute for objective market research and actual customer feedback.

- Ignoring Qualitative Insights: It’s easy to get lost in spreadsheets and market size data, but you can’t forget the human element. When you overlook the qualitative feedback from social listening—the raw complaints, frustrations, and desires—you completely miss the why behind the numbers.

- Underestimating Resources: A fantastic opportunity is worthless if you don’t have the resources (time, money, talent) to actually do something about it. So many businesses fail because they underestimate the investment required to enter a new market or launch a new product, stretching themselves way too thin to succeed.

The core principle is simple: Always let data and genuine customer insights lead the way. Your assumptions are just a starting point; validation is where the real work begins.

Can a Small Business Really Use Social Listening AI?

Absolutely. There's this stubborn myth that powerful tools like AI-driven social listening are only for big corporations with massive budgets. That idea is completely outdated. The technology has become way more accessible and user-friendly, leveling the playing field for businesses of all sizes.

You no longer need a dedicated team of analysts or a six-figure software budget to get started. Modern platforms are designed for agility and affordability, allowing even solopreneurs to tap into incredibly powerful insights.

Even small-scale social listening that's laser-focused on a specific niche can be a total game-changer. It helps you:

- Understand Niche Pain Points: Pinpoint the exact problems your target customers are struggling with, in their own words.

- Find High-Intent Leads: Identify individuals who are actively looking for a solution right now.

- Outmaneuver Larger Competitors: Stay closer to the customer conversation than bigger, slower-moving companies ever could.

For a small business, this isn't just a "nice-to-have" tool. It’s a strategic advantage that lets you compete on intelligence and agility instead of just budget.

Ready to stop guessing and start listening to what your customers are really saying? Intently scans millions of conversations across Reddit, X, and LinkedIn to find high-intent leads and market opportunities for you. See how our AI can fill your pipeline by visiting https://intently.ai.