Build a Social Listening Report That Drives Strategy

A social listening report is your brand's secret weapon, turning all that scattered online chatter into a clear, actionable roadmap for your business. It doesn't just show you where you've been; it uses real-time conversations from Twitter threads to TikTok comments to chart the best path forward. This is how you start making proactive decisions instead of just reacting to the noise.

Why a Social Listening Report is Your Strategic Compass

Imagine trying to navigate a ship through a storm using only a rearview mirror. You'd see the chaotic waves you just passed, but you would have zero clue what’s coming next. That’s what relying on old-school performance metrics feels like.

A social listening report, on the other hand, is your forward-facing sonar, your weather radar, and your GPS all rolled into one. It doesn’t just count mentions; it reads the entire digital ocean for you. It deciphers the tone of the conversations, the emotions driving the comments, and the trends just starting to form over the horizon. That's what lets you steer your brand with real confidence.

From Reactive Noise to Proactive Strategy

Too many brands get stuck in the monitoring trap, which is purely reactive. It’s about collecting mentions and putting out fires one comment at a time. Social listening—and the reports it fuels—is a completely different ballgame. It’s all about digging into the why behind the conversations.

A solid social listening report answers the big questions:

- What are our customers really frustrated about right now?

- Which of our competitor’s new features is actually getting buzz?

- Is the feeling around our brand getting better after our last campaign?

- What’s that emerging trend that could be our next big product idea?

When you pull this data into a structured report, you create an invaluable asset. It’s the difference between hearing a single customer complaint and spotting a widespread product flaw before it blows up into a crisis. This strategic shift is crucial for a healthy online presence and a core part of effective social media reputation monitoring.

The Growing Importance of Listening

The rush to adopt social listening tools has been massive. Today, 62% of marketers use them to shape their strategies and measure ROI, making it their second-highest priority on social media.

The numbers don't lie. The global social listening market is expected to nearly double, jumping from $9.61 billion in 2025 to a whopping $18.43 billion by 2030. This shows it’s no longer a niche tool but a core business function.

A social listening report turns messy, unstructured social data into a clear, actionable story. It tells you not just what people are saying, but what it means for your business tomorrow.

At the end of the day, a social listening report is more than a document; it's a decision-making engine. It gives you the context you need to innovate products, sharpen your messaging, and build stronger customer relationships—making sure your brand doesn't just survive the storm but sails right through it.

Choosing the Metrics That Actually Matter

A social listening report is a story, and the right metrics are your main characters. It's tempting to get caught up in surface-level numbers like likes and shares, but those don't tell you much. The real magic happens when you find the data that uncovers why people are talking and what it all means for your business.

Think of it like a doctor with a patient. A high temperature is a good starting point, but the real diagnosis comes from figuring out the cause. Is it a minor cold or something more serious? In the same way, a sudden spike in brand mentions is just a number until you dig into the sentiment, share of voice, and key conversation themes behind it.

To build a report that actually drives strategy, you need to focus your metrics on four critical areas. This approach makes sure you’re not just hoarding data, but turning it into real intelligence that guides your next move.

Brand Health and Perception

This is ground zero for your social listening report. It answers the most basic question: "How do people really feel about us?" These metrics give you a clear read on how your brand is seen and how visible it is online.

- Sentiment Analysis: This is way more than just counting mentions. It sorts conversations into positive, negative, or neutral buckets, giving you a constant pulse check on your brand’s reputation. A sudden drop in sentiment can be your first warning sign that a PR crisis is brewing or a product has a serious flaw.

- Share of Voice (SOV): This metric shows how much of the online conversation in your industry you actually own compared to your competitors. If you and three competitors are in the mix, what slice of that conversational pie is yours? A growing SOV is a great sign that your marketing efforts are cutting through the noise.

Audience and Consumer Intelligence

Your audience is out there, every single day, talking about what they want, what they need, and what drives them crazy. These metrics are your ticket into those conversations, helping you understand your customers on a much deeper level. For a closer look at this, check out these insights on what metrics really matter and how new tech can help you find them.

This kind of intelligence is pure gold for your product, marketing, and content teams. It’s like having a direct line into the minds of your customers.

A social listening report uncovers the "why" behind what your customers do. It shines a light on the unmet needs and frustrations they might not even think to tell you about, giving you a massive edge over the competition.

Competitive Landscape Analysis

You aren't operating in a bubble. Knowing what your competitors are up to—and more importantly, how people are reacting to it—is essential. It helps you find your own unique space in the market, and a good social listening report gives you all the context you need.

A few key metrics to track for your competitors include:

- Competitor Mention Volume and Sentiment: Keep an eye on how often your competitors are mentioned and whether the chatter is good or bad. Are they launching a new product to rave reviews? Or are they drowning in customer complaints you can learn from?

- Feature and Campaign Analysis: Listen in on conversations about their specific campaigns or product features. You might spot a brilliant tactic you can adapt for your own brand, or you could find a major gap in their offering that you can swoop in and fill. For instance, if everyone is complaining about their confusing app interface, that’s a golden opportunity for your product team.

Campaign Performance and Impact

Finally, your report has to measure the real-world impact of your own marketing. This is where you close the loop and show the ROI on all your hard work. These metrics reveal how well your campaigns are actually connecting with people in real-time.

- Conversation Volume Over Time: Track mentions of your campaign hashtags, slogans, and keywords. Did you see a huge spike during your launch week? More importantly, did that momentum last, or did the conversation die down as soon as you stopped posting?

- Engagement Rate Analysis: Look at how people are interacting with your campaign content. High engagement is a clear signal that your message is hitting home with the audience you’re trying to reach.

By structuring your report around these four pillars, you build a narrative that’s both complete and easy to act on. Each metric adds another layer to the story, turning raw data into a strategic roadmap for your entire organization.

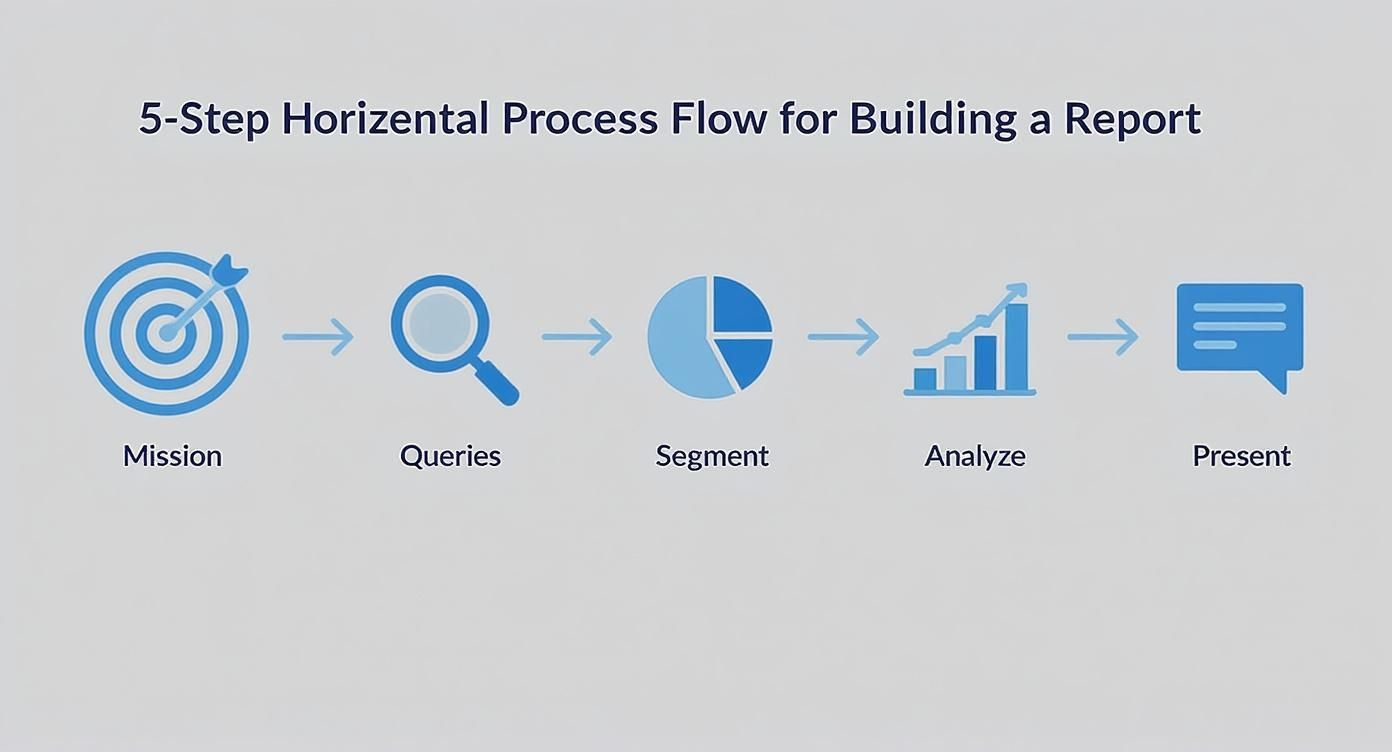

Your Step-by-Step Guide to Building the Report

Let's be honest, building a social listening report from scratch can feel a little intimidating. But it’s really just a structured process that turns a mountain of raw data into a clear, compelling story. It's less like writing a dense academic paper and more like putting together a puzzle—you start with the corners and edges, and then the picture starts to emerge piece by piece.

Each step naturally builds on the one before it, taking you from a simple question to a finished, insightful document that people will actually want to read.

This visual gives you a bird's-eye view of the entire workflow, from setting your goals all the way to presenting what you found.

This process shows how each stage logically connects to the next, making sure your final report is built on a solid foundation of clear goals and well-defined data.

Step 1: Define Your Mission

Before you pull a single tweet or post, you have to know why you're doing this. A report without a clear mission is just noise. You need to ask yourself: what specific business question am I trying to answer? A vague goal like "see what people are saying about us" is a recipe for a messy, unfocused report that no one will use.

Get specific with your mission. Frame it like this:

- "How is our new product feature being received compared to our main competitor's?"

- "What are the top 3 pain points customers mention when talking about our industry on Reddit?"

- "Is the sentiment around our brand improving month-over-month since our last campaign?"

A sharp, focused question is your North Star. It guides every single decision you make from here on out.

Step 2: Set Up Your Listening Queries

With your mission locked in, it’s time to build the digital "nets" that will catch the right conversations. This means creating super-precise listening queries. Think of it like tuning an old-school radio—you need to dial into the exact frequency to get the music, not a wall of static. A core part of building an effective report involves collecting data, and a key technique for this is understanding methods like social media scraping.

The best queries use Boolean logic, combining your keywords with operators like AND, OR, and NOT to zero in on what you need. For example, if you're a project management software company, just searching for "project management" will drown you in millions of irrelevant results.

A much smarter query might look something like this: ("project management tool" OR "task software") AND ("frustrated" OR "issue" OR "looking for") NOT "YourCompetitorName". This little snippet captures relevant conversations while filtering out the junk.

Pro Tip: Don't forget to include common misspellings of your brand, products, and even key executives' names. People make typos all the time, and those conversations are just as valuable.

Step 3: Segment and Categorize the Data

Once your queries start working their magic, you'll have a flood of raw mentions coming in. Your next job is to bring some order to this chaos by sorting everything into meaningful buckets. This is segmentation, and it's where raw data starts turning into real intelligence.

Here are a few common ways to slice up the data:

- By Theme or Topic: Grouping mentions by a specific product feature, campaign name, or customer service issue.

- By Sentiment: Automatically or manually tagging mentions as positive, negative, or neutral.

- By Source: Separating what’s being said on X from conversations on LinkedIn or industry forums.

This step helps you move past a single, overwhelming number of mentions and start seeing the different narratives taking shape within your data.

Step 4: Analyze and Find the "Why"

Alright, time to put on your detective hat. With your data all neatly segmented, you can start digging into the trends and uncovering the story behind the numbers. This is easily the most critical part of the whole process. A chart showing a spike in negative sentiment is interesting, but the real value is explaining why it happened.

Look for patterns and ask deeper questions:

- Did that spike in negative mentions happen right after our latest app update?

- Are most of the positive comments coming from a specific demographic?

- What keywords show up most often alongside our competitor’s brand name?

Connecting these dots is how you go from simple observations ("what happened") to powerful insights ("why it happened and what it means for us").

Step 5: Craft Your Narrative and Visualize

Finally, you need to present what you've found in a way that your stakeholders will actually understand and care about. They don't have time to wade through spreadsheets; your job is to tell them the story. Lead with your most important finding—the "so what"—and then use the data to back it up.

Use clear, simple data visualizations to make your points impossible to ignore. A pie chart can show a sentiment breakdown way more effectively than a paragraph of text, and a line graph is perfect for showing how share of voice has changed over time. Always pick the chart that tells your story in the clearest, most direct way.

And don't forget to pair these visuals with direct quotes from customers. It adds a powerful, human element that brings the data to life.

Report Templates for Different Business Needs

A social listening report is never a one-size-fits-all document. The format, the metrics, and even how often you send it out have to be perfectly matched to what you’re trying to accomplish.

After all, a report for a fast-moving marketing team tracking a campaign launch looks completely different from one built for the C-suite during a crisis. Choosing the right structure is what turns raw data into something your team can actually use.

To give you a head start, here are three battle-tested templates you can adapt for your own needs. Each one is designed for a specific purpose and audience.

The Weekly Brand Pulse Report

Think of this as your brand’s regular health checkup. The Weekly Brand Pulse is a quick, at-a-glance dashboard designed for marketing and social media teams who need to stay on top of things. The whole point is to give a consistent, high-level overview of brand health without getting bogged down in the details.

This report is all about what’s happening right now. It’s perfect for weekly team meetings, letting managers quickly spot anything unusual, celebrate wins, and adjust tactics for the week ahead.

What to Include:

- Mention Volume Trend: A simple line graph showing mentions over the past seven days. It’s the fastest way to see conversation spikes or dips.

- Sentiment Breakdown: A pie chart showing the mix of positive, negative, and neutral mentions for the week.

- Top Mentions: A hand-picked list of the 3-5 most impactful mentions, both good and bad. This adds the human story behind the numbers.

- Emerging Themes: A word cloud or a short bulleted list of new topics or keywords popping up in conversations.

The goal here is speed and clarity. Someone should be able to digest this report in less than five minutes and walk away knowing exactly where things stand.

The Monthly Competitor Deep-Dive

This is your strategic reconnaissance mission. The Monthly Competitor Deep-Dive is a much more comprehensive analysis built for strategists, product managers, and leadership. It shifts the focus from your own brand to the entire competitive landscape.

The goal is to spot strategic opportunities and threats by seeing how your rivals are doing. It helps answer big questions like, "Where are our competitors winning?" or "What customer pain points are they completely ignoring?" Some teams even use these insights to sharpen their sales outreach, as a deep understanding of competitor weaknesses can inform everything down to the complete guide to AI lead generation tools and strategies.

A strong competitor report doesn’t just show what your rivals are doing; it reveals the gaps in the market they’ve left wide open for you.

What to Include:

- Share of Voice (SOV) Comparison: A bar chart comparing your brand’s SOV against 2-3 key competitors over the last month.

- Sentiment Benchmarking: A side-by-side comparison of sentiment scores for your brand versus your competitors.

- Competitor Campaign Analysis: A quick summary of major campaigns your rivals launched, including how the audience reacted and what you can learn from it.

- Feature Request & Complaint Analysis: A categorized list of what customers are asking for or complaining about with competitor products. This is a goldmine for your own product roadmap.

This report is less about the daily chatter and more about identifying the major strategic shifts happening in your market.

The Real-Time Crisis Report

When a crisis hits, you need information that is fast, focused, and filtered. The Real-Time Crisis Report is a special-purpose brief created for PR, communications teams, and executive leadership during a critical event. Its only job is to provide an accurate, up-to-the-minute picture of a developing situation.

This isn’t a scheduled report; you spin it up on demand. It cuts through all the noise to deliver only the essential information needed to make urgent decisions. The format needs to be direct, factual, and easy to share.

What to Include:

- Executive Summary: A single paragraph explaining the situation, the current impact, and how sentiment is trending.

- Mention Volume Over Time: An hourly line graph tracking crisis-related keywords. This shows you how fast the story is spreading.

- Key Message Penetration: An analysis of how your official statements are being shared versus any misinformation that’s circulating.

- Influential Voices & Media: A running list of the key journalists, influencers, or high-profile accounts driving the conversation.

In a crisis, clarity is king. This report gives your team the situational awareness they need to navigate the storm and communicate with confidence.

Social Listening Report Types and Their Use Cases

Not sure which report to start with? This table breaks down the primary goal, frequency, and audience for each template to help you pick the right one for the job.

| Report Type | Primary Goal | Frequency | Audience |

|---|---|---|---|

| Weekly Brand Pulse | Monitor brand health and track conversation trends. | Weekly | Marketing & Social Media Teams |

| Monthly Competitor Deep-Dive | Identify market opportunities and competitive threats. | Monthly | Strategists, Product Managers, & Leadership |

| Real-Time Crisis Report | Provide situational awareness during a critical event. | As Needed (On-Demand) | PR, Communications, & Executive Leadership |

Each report serves a distinct function. The key is to match the depth and frequency of your reporting to the specific business questions your stakeholders need answered.

Turning Your Report into Actionable Insights

A social listening report that just collects digital dust on a server is a massive missed opportunity. The final, and honestly most important, step in this whole process is turning all that carefully gathered data into real strategic decisions that actually move the needle for your business. This is where your hard work pays off, transforming charts and numbers into a catalyst for change.

Let's be clear: data on its own is pretty meaningless. Your report’s true value comes from the story it tells and the actions it inspires. Without clear recommendations, even the most detailed analysis is just noise.

Answering the "So What?" Question

Every single metric, chart, and data point in your report has to answer one simple question for your audience: "So what?" A graph showing a 15% drop in positive sentiment is an observation, not an insight. The real insight is digging into the why behind that drop and figuring out the what now for the business.

Your job as the analyst is to connect the dots. Don’t just present your findings; interpret them. You have to guide your stakeholders by explaining the business implications of every piece of data you share.

- Observation: "Mentions of 'buggy update' spiked by 200% this week."

- Actionable Insight: "That recent spike in 'buggy update' mentions correlates directly with our latest app release, pointing to a critical user experience issue. We recommend the product team prioritize a patch within the next 48 hours to prevent more customer churn and negative reviews."

The difference between a good report and a great one is the shift from just reporting what happened to recommending what to do next. Always lead with the strategic recommendation, then use the data to back it up.

Tailoring Insights to Your Audience

Not everyone needs the same level of detail. A report that buries the C-suite in raw data will get ignored, but a high-level summary might not give the social media team enough to actually work with. Customizing your recommendations for different teams is absolutely essential.

This is especially true today. The average person uses 6.83 different social networks every month, and 78% of people prefer short-form video when learning about new products. This complex behavior means your insights need to be versatile, addressing challenges on platforms from TikTok to Instagram. It’s worth taking some time to discover more about evolving social media behaviors to keep your insights sharp.

The Power of the Raw Customer Voice

Never, ever underestimate the impact of a real customer quote. While charts and graphs are great for showing scale, a raw, unfiltered comment adds a powerful human element that data alone just can't capture. Sprinkling direct quotes throughout your social listening report makes the insights far more memorable and emotionally resonant.

Instead of just saying, "Negative sentiment is increasing," include a screenshot of a real tweet that says, "I used to love this brand, but the new checkout process is a nightmare. I just gave up." That single comment often does more to spur action than an entire page of analytics.

Common Pitfalls to Avoid:

- Data Dumping: Resist the urge to include every single piece of data you found. Your job is to curate the findings to tell a clear, focused story.

- Ignoring Business Goals: Every single recommendation must tie back to a core business objective, whether that’s increasing sales, improving customer satisfaction, or protecting the brand's reputation.

- Using Vague Language: Avoid fuzzy suggestions like "we should engage more." Instead, offer specific, measurable actions like "we need to create three video tutorials addressing the top customer complaints we’re seeing."

By focusing on clear, audience-specific, and actionable recommendations, your social listening report will become an indispensable tool for strategic planning and decision-making across the entire organization.

Common Questions About Social Listening Reports

Even with the best tools and templates, getting a social listening report just right can bring up some tricky questions. That’s completely normal. Moving from a pile of data to a real strategy means navigating a few common hurdles that nearly every team runs into.

Let's tackle some of the most frequent questions that pop up. We’ll give you clear, straightforward answers to help you sharpen your process, justify your efforts, and turn your reports into something your organization can't live without.

How Often Should I Run a Social Listening Report?

One of the first questions people ask is about timing: Should reports be daily, weekly, or monthly? The honest answer is there’s no single "right" frequency. The best schedule for your social listening report depends entirely on your goals and what’s happening in your business at that moment.

Think of it like checking your GPS. If you’re navigating a busy, fast-moving city (like during a product launch), you want real-time, turn-by-turn directions. But if you’re on a long, straight highway (like during a stable business period), checking in every hour or so is plenty.

Here’s a simple way to match your reporting cadence to your goals:

- Daily Reports: These are for high-stakes situations. Think a PR crisis, a major event, or the first 48 hours of a huge campaign launch. The goal here is immediate awareness of what's happening.

- Weekly Reports: This is the sweet spot for ongoing brand health monitoring and campaign tracking. It's perfect for marketing teams to spot trends, adjust their tactics, and keep a pulse on weekly performance.

- Monthly Reports: Best for strategic overviews and deep dives into competitor analysis. These reports give leadership a bigger-picture view, focusing on long-term trends like share of voice and sentiment shifts over time.

Ultimately, you want to line up your reporting schedule with your team’s decision-making cycle. The report should land on their desk just in time to inform the next set of choices.

What Tools Are Best for Creating Reports?

Choosing the right social listening tool can feel overwhelming, but it really boils down to finding a platform that’s good at turning raw data into a clear story. The best tools don't just collect mentions; they help you analyze, visualize, and share what you've found.

When you're looking at different software, don't just get wowed by the number of platforms it covers. Focus on the features that actually make the reporting process easier and your analysis deeper.

The most powerful social listening tools are those that automate the heavy lifting of data analysis, freeing you up to focus on what truly matters: the story behind the numbers and the strategic actions you should take next.

Key Features to Look For in a Social Listening Tool

- Dashboard Customization: Your tool has to let you build reports that reflect your specific KPIs. A rigid, one-size-fits-all dashboard just won’t work. You need the flexibility to drag and drop widgets, switch up chart types, and put the metrics that matter most to your stakeholders front and center.

- Advanced Data Visualization: Look for a good variety of clear, easy-to-read charts and graphs. The platform should make it simple to see sentiment trends, compare share of voice, and create word clouds to spot emerging themes at a glance.

- Automated Reporting and Alerts: The ability to schedule reports and set up real-time alerts for things like keyword spikes or sudden sentiment shifts is a huge time-saver. It keeps you and your team in the loop without having to manually check all the time.

- Data Security and Privacy: Make sure the tool complies with data protection regulations. It's crucial to understand how your data—and your audience's data—is handled, so always check out the platform's policies. You can learn about our commitment to user data in our privacy policy.

How Can I Demonstrate the ROI of My Reports?

This is the million-dollar question for a lot of analysts. A social listening report is a powerful tool, but to justify the investment in time and software, its value has to be tied to real business outcomes. Proving ROI means you have to move beyond social metrics and connect your insights to core business goals.

The trick is to frame your findings in the language of business impact. Your stakeholders care about customer acquisition, retention, and revenue. Your report should clearly show how social listening is helping in those areas.

Here are a few practical ways to connect your social listening report to real-world ROI:

- Crisis Aversion: Calculate the potential cost of a crisis you helped avoid. By catching a surge in negative sentiment early, you can quantify the value by estimating the potential loss in sales or brand equity that was prevented. A single averted crisis can pay for your social listening program for years.

- Improved Customer Satisfaction: Track sentiment scores over time and see how they line up with customer support metrics like ticket volume or CSAT scores. If your insights led to product improvements that cut down on customer complaints, that’s a direct link to operational efficiency and retention.

- Lead Generation: Monitor conversations for buying signals, like when users ask for recommendations or complain about a competitor's product. When your sales team converts these leads, you can trace that revenue directly back to your social listening work.

- Competitive Intelligence: Show how insights from watching competitors led to a successful strategic shift. For example, if you found a gap in a competitor's product and your company moved to fill it, you can tie the revenue from that new feature right back to your report's findings.

By consistently framing your insights around these business outcomes, you change your social listening report from a simple summary of online chatter into a proven driver of business growth.

Ready to turn social conversations into qualified leads and actionable insights? Intently uses advanced AI to monitor platforms like Reddit and X, delivering high-intent prospects directly to you. Stop searching and start engaging. Discover how our platform can drive your GTM strategy by visiting https://intently.ai.