What Is Market Intelligence and How Does It Work?

Here's the simple truth: Market intelligence is how you gather and make sense of everything happening outside your company's walls so you can make smarter decisions inside them.

Think of it like a GPS for your business. It doesn't just show you one road; it reveals the entire landscape—traffic patterns, competitor routes, and even new shortcuts you didn't know existed. It's about navigating market trends, competitor moves, and customer chatter with a full map in hand.

Defining Market Intelligence Beyond The Buzzwords

It’s easy to mix up market intelligence with market research, but they're fundamentally different beasts.

Market research is like taking a snapshot. It’s a focused, one-time project designed to answer a specific question, like, "What do our customers in the Midwest think of our new feature?" It’s great for getting a clear picture of a single moment.

Market intelligence, on the other hand, is more like a continuous live video feed. It’s an ongoing process that pulls together information from all over the place to give you a dynamic, holistic view of your entire market. We're talking way beyond just surveys and focus groups. This is about building a living, breathing understanding of your world.

To clear things up, let's break down how market intelligence, market research, and competitive intelligence fit together. While they're all related, they each play a distinct role in shaping business strategy.

Market Intelligence vs Market Research vs Competitive Intelligence

| Aspect | Market Intelligence | Market Research | Competitive Intelligence |

|---|---|---|---|

| Scope | Broad and ongoing view of the entire market environment. | Focused, project-based inquiry on a specific topic. | Narrow focus on direct and indirect competitors. |

| Timeframe | Continuous and real-time. | A specific point in time. | Ongoing, but with a specific focus on rival activities. |

| Goal | To inform strategic, long-term business decisions. | To answer a defined business question. | To anticipate and react to competitor actions. |

| Sources | Social media, forums, news, economic data, competitor actions. | Surveys, focus groups, interviews, customer data. | Competitor websites, press releases, product launches, pricing changes. |

Ultimately, market research and competitive intelligence are components of a broader market intelligence strategy. They all work together to give you the clearest possible picture of where you stand and where you should go next.

What Does The "Live Feed" Actually Capture?

So, what kind of information are we pulling in for this all-seeing view? A solid market intelligence program synthesizes data from several key areas:

- Competitor Activity: This goes beyond just knowing who your rivals are. It's about tracking their pricing changes, new product launches, big marketing campaigns, and even who they're hiring.

- Customer Conversations: This is where social listening shines. We're monitoring social media, forums like Reddit, and review sites to hear what people are really saying about you, your competitors, and the industry as a whole.

- Market Trends: You need to spot the waves before they hit the shore. This means identifying emerging technologies, shifts in what consumers want, and new regulations that could shake things up.

- Economic Indicators: Keeping an eye on the bigger picture is crucial. Broader economic factors influence everything from customer spending power to business investment.

This wide-ranging approach is exactly why investment in this space is exploding. The market research services industry, a key piece of the puzzle, has ballooned from $71.5 billion in 2016 to a projected $140 billion in 2024. That surge tells you everything you need to know about how vital this has become. You can explore more about these industry statistics to see the full picture.

Market intelligence transforms raw data into a strategic narrative. It connects the dots between a competitor's new job posting, a trending hashtag on X, and a shift in economic policy to reveal not just what is happening, but why it’s happening—and what you should do about it.

The Four Pillars of Modern Market Intelligence

To really get what market intelligence is all about, think of it as a solid structure built on four essential pillars. Each one represents a critical stream of information, and when you put them all together, you get a complete, 360-degree view of your business landscape. If you ignore even one, you're left with a massive blind spot.

A smart market intelligence strategy doesn't just collect data; it weaves together insights from these four areas to help you make confident decisions. This integrated approach is a big reason the industry is booming. The global market intelligence market was valued at $12.1 billion in 2024 and is expected to hit $21.4 billion by 2031, all thanks to the growing need for data-backed business strategies. You can check out the full research on market intelligence growth projections on 6wresearch.com.

Let's break down each pillar to see how they work in tandem.

1. Competitor Intelligence

This pillar is all about knowing your rivals almost as well as you know yourself. We're not just talking about a simple list of who they are. It's a deep dive into their strategies, their strengths, and, most importantly, their weaknesses.

- What are they launching? Keeping tabs on new products or feature updates gives you a peek into their roadmap.

- How are they marketing? Analyzing their campaigns shows you who they’re trying to reach and the story they're telling.

- What are their customers saying? Monitoring social media and review sites for their brand name can uncover golden opportunities. For example, a software company might notice a flood of negative reviews about a competitor's confusing UI. That's a clear signal to double down on marketing your own intuitive design. This is where effective social media reputation monitoring comes in—for both your brand and theirs.

2. Product Intelligence

While competitor intelligence looks outward, product intelligence looks at the performance and perception of products in the market—yours and everyone else's. This pillar answers the most basic question of all: are we building something people actually want to buy?

It involves digging into user reviews, support tickets, and social media chatter to spot common complaints and highly-requested features. This data feeds directly back into your product development, making sure you don't end up building in a bubble.

By connecting what customers are complaining about with a competitor's product to what your team is building next, you create a direct line between market demand and your product roadmap.

3. Market Understanding

This pillar means zooming out to see the bigger picture. Market understanding is all about the broad trends, industry shifts, and economic currents that could rock your boat. It’s about spotting the wave before it turns into a tsunami.

Key activities here include:

- Tracking regulatory changes that could open up new markets or create new headaches.

- Identifying emerging technologies that could disrupt the entire industry.

- Analyzing shifts in consumer behavior and cultural attitudes.

This high-level view helps you see what's coming, allowing you to shift your strategy proactively instead of scrambling to react.

4. Customer Understanding

Finally, we get to the most important pillar: getting to know your customer on a deep level. This goes way beyond basic demographics. It’s about understanding their motivations, their frustrations, and the "why" that drives their buying decisions.

By analyzing conversations on platforms like Reddit or LinkedIn, you can uncover the exact language your audience uses to describe their problems. This intelligence is gold for your marketing, sales, and product teams. It lets them craft messaging that truly connects and build solutions that solve real-world problems.

Building Your Market Intelligence Engine

Turning raw data into strategic wins doesn’t happen by accident. It's a structured process. Think of your market intelligence program like building an engine—each part has to work in sync to generate power and drive your business forward. This engine runs on a continuous cycle: plan, collect, analyze, and act.

Let's follow a hypothetical B2B SaaS startup. They've built a great product but are having a tough time standing out in a packed market. By putting a market intelligence cycle in place, they can go from reacting to market shifts to proactively shaping their own success.

The Planning and Scoping Phase

Before you even think about collecting data, you need to know where you're going. What specific business questions are you trying to answer? A goal like "understand the market" is way too broad to be useful.

Our startup needs to get specific. Their objectives might look something like this:

- Objective 1: Pinpoint the top three pain points our competitor's customers complain about most on Reddit and X.

- Objective 2: Uncover which new features our target audience is actively requesting for products like ours.

- Objective 3: Find high-intent conversations where potential buyers are looking for solutions we offer, right now.

These sharp, focused goals act as a filter, saving the team from drowning in a sea of irrelevant information. They make sure every piece of data gathered is aimed directly at informing sales, marketing, and product development. This is the blueprint for the entire operation.

A well-defined objective is the difference between aimless data hoarding and purposeful intelligence gathering. It ensures every piece of data you collect has a job to do.

Data Collection and Aggregation

With clear objectives set, the next step is gathering the right external signals. This isn't about collecting all the data; it’s about collecting the right data. For our startup, this means setting up social listening streams to track specific keywords, competitor brand names, and industry hashtags across platforms like LinkedIn, X, and Reddit.

Modern tools take care of most of the heavy lifting. Instead of a team member manually scrolling through endless feeds, an AI-powered platform can scan millions of conversations 24/7. It surfaces the relevant posts and filters out the noise, delivering a clean feed of high-value information. You can check out our complete guide to AI lead generation tools to see how automation can fuel your collection efforts.

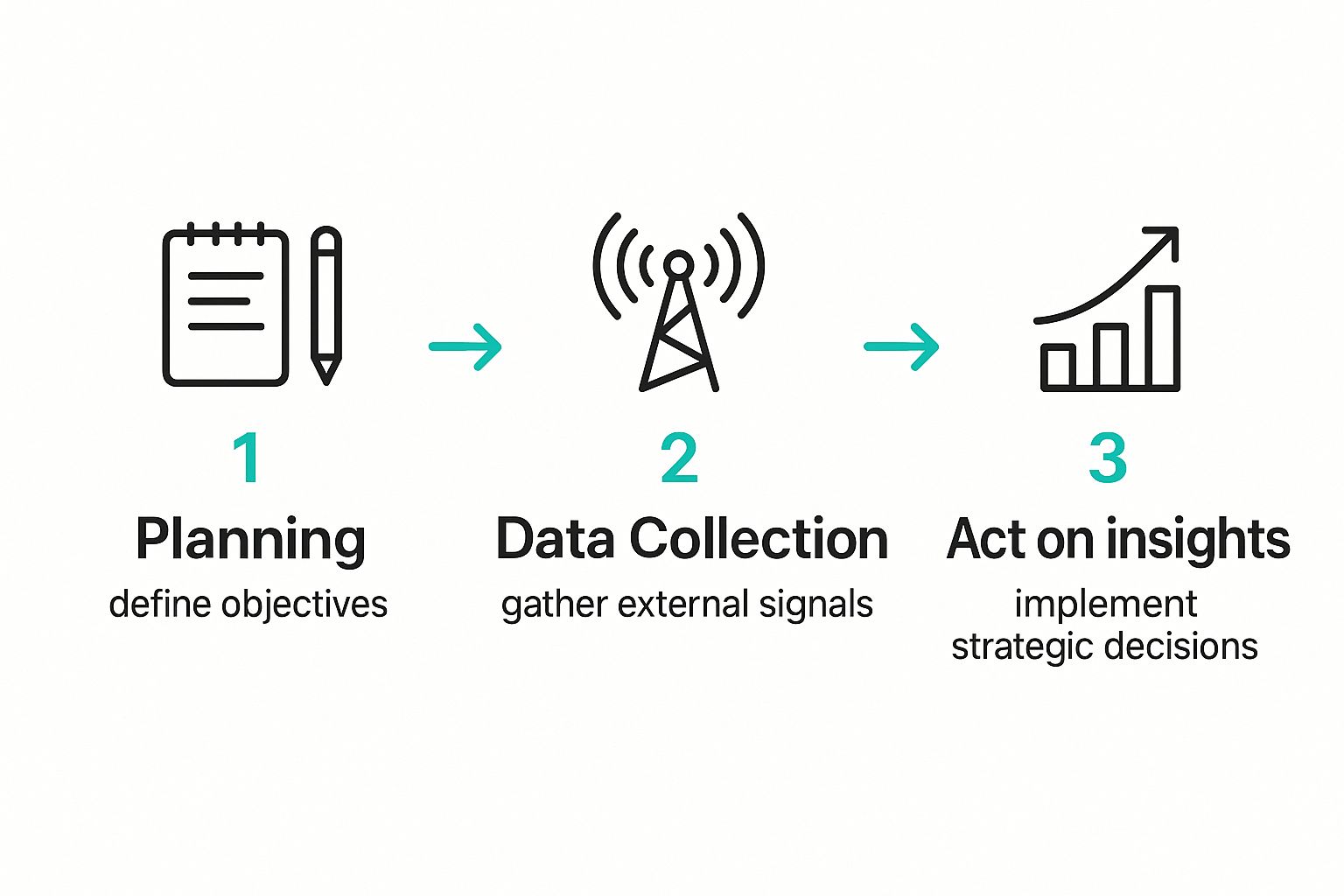

This infographic breaks down the core flow of turning raw data into a real strategy.

As you can see, a successful market intelligence program is a streamlined process, not just a chaotic data grab. It’s about building a system that consistently delivers valuable insights.

A market intelligence program isn’t a one-off project; it’s a continuous cycle where each stage feeds the next. Here’s a simple breakdown of what that looks like in practice.

Stages of the Market Intelligence Cycle

| Stage | Key Objective | Example Activities |

|---|---|---|

| 1. Planning | Define clear business questions to answer. | - Set specific goals (e.g., "Identify competitor weaknesses"). - Determine which data sources to monitor. |

| 2. Collection | Gather relevant external signals and data. | - Set up social listening for keywords. - Track competitor mentions and industry hashtags. |

| 3. Analysis | Turn raw data into actionable insights. | - Identify recurring themes and pain points. - Synthesize findings into strategic recommendations. |

| 4. Action | Operationalize insights across GTM teams. | - Arm sales with competitive intel. - Launch new marketing campaigns. - Inform product roadmap decisions. |

By moving through these stages systematically, teams can ensure they're not just collecting data for the sake of it, but are actively using it to gain a competitive edge.

Analysis and Action

This is where the magic happens. The final—and most critical—phase is turning all that collected data into insights you can actually use. Raw data is just noise; analysis is what gives it meaning.

- Synthesize Findings: The startup's team sifts through the conversations they’ve collected. A pattern quickly emerges: users of a major competitor are constantly frustrated with its slow customer support and the lack of a key integration.

- Formulate a Strategy: Armed with this insight, the marketing team crafts a new campaign. The headline? It highlights their own company's award-winning 24/7 support and seamless integration capabilities.

- Enable the Team: The sales team now has specific, actionable competitive intel. When a prospect mentions they're looking at the competitor, the sales rep can confidently ask about their concerns around support, positioning their solution as the clear winner.

- Inform the Roadmap: The product team notices dozens of requests for a specific feature their solution already has, but it isn't well-marketed. They immediately prioritize creating new tutorials and marketing materials to shine a spotlight on this existing strength.

By sticking to this cycle, the startup doesn't just gather data—they put it to work. They turn public conversations into a true competitive advantage, fueling smarter marketing, sharper sales conversations, and a better product.

Unlocking Your Competitive Advantage with MI

Putting market intelligence to work isn't just about gathering interesting facts; it's about building a real, measurable edge over the competition. A solid MI program gives you tangible benefits that sharpen every part of your go-to-market strategy, turning passive observation into proactive, game-winning moves.

Think of it as the difference between playing checkers and playing chess. While your competitors are busy making one-dimensional moves, market intelligence lets you see the entire board. You can anticipate threats, spot opportunities, and position your company for victory several steps ahead.

This kind of strategic foresight has a direct impact on the bottom line. And the proof is in the numbers: research shows that 75% of world-class organizations strongly agree their investment in market intelligence has paid off handsomely.

Sharpen Your Go-to-Market Strategy

Without intelligence, a product launch feels like a shot in the dark. With it, it’s a calculated strike. Market intelligence delivers the critical insights you need to make sure your product, pricing, and messaging are perfectly aligned with what the market actually wants, right now.

- Product-Market Fit: By analyzing customer pain points and feature requests pulled from social channels, you can validate your product roadmap and build what people are already asking for.

- Pricing Power: Monitoring competitor pricing and promotions helps you position your own offers competitively without leaving money on the table.

- Messaging Resonance: When you understand the exact language your audience uses to describe their problems, you can craft marketing copy that connects on a much deeper level.

Anticipate Competitor Moves

One of the most powerful benefits of MI is the ability to shift from a reactive stance to a proactive one. Instead of getting caught off guard by a competitor's new campaign or product update, you can see the signs coming and prepare your response well in advance.

A crucial application of market intelligence is in gaining a competitive edge, where understanding how to conduct a competitive analysis becomes paramount. By tracking a rival's job postings, for example, you might predict their expansion into a new market.

This foresight lets you control the narrative. You can prepare counter-messaging, get your sales team ready for new objections, or even adjust your own product roadmap to neutralize a threat before it fully materializes.

Mitigate Business Risks

Market intelligence also acts as your early warning system. By keeping a constant pulse on market trends, public sentiment, and even regulatory shifts, you can spot potential risks before they snowball into full-blown crises.

This could be anything from a brewing PR issue you identify through negative social media chatter to a disruptive new technology gaining traction in your space. Spotting these signals early gives you precious time to adapt your strategy, manage your reputation, and protect your business from unforeseen challenges.

Ultimately, it’s about navigating the market with confidence, backed by a clear view of the road ahead.

Putting Market Intelligence into Action

Theory is great, but market intelligence truly comes alive when you put it to work. For go-to-market (GTM) teams, these insights aren't just "nice to have"—they're the fuel for smarter strategies, sharper messaging, and, ultimately, more revenue. This is where the data meets the real world.

When you integrate market intelligence properly, it completely changes how key departments operate. It closes the gap between what the market is saying and what your teams are doing, making sure everyone is working from the same, up-to-date playbook. This is what true data-driven decision making looks like in an organization.

Empowering Sales and Marketing Teams

For sales and marketing, market intelligence is a direct line into the customer's mind. It gives them the context they need to create campaigns that actually land and sales pitches that solve real, timely problems.

For Sales Teams: Imagine your sales rep hopping on a call already knowing the prospect’s current provider is dropping the ball on customer support. That little nugget, pulled from social listening, lets the rep pivot immediately to highlight your company’s stellar service. Suddenly, a competitor's weakness becomes your biggest selling point. It’s a world away from generic messages; you can learn more about why cold outreach doesn't work anymore and how intelligence-led approaches win.

For Marketing and Content Teams: Content creators can finally stop guessing what topics will hit home. By tuning into online discussions, they can pinpoint the exact questions their audience is asking and even the specific language they use. This lets them craft blog posts, webinars, and social content that people actually want to read, boosting engagement and cementing their status as thought leaders.

When you operationalize intelligence, GTM teams move from making assumptions to making informed decisions. A marketing campaign is no longer based on what the team thinks will work; it's based on what the market is explicitly telling them it wants.

Integrating Intelligence into Daily Workflows

For market intelligence to have any real impact, it needs to become a habit, not a one-off project. This means weaving insights into the tools and routines your teams already use every day. When you build this culture, data-backed insights become everyone's responsibility.

Artificial intelligence has been a massive help here. AI-driven platforms can dig through enormous data sources like social media and online forums, using natural language processing to serve up real-time consumer sentiment directly to your team. This allows companies to adjust strategies and react to competitors with incredible speed.

Here are a few practical ways to make MI a core part of your operations:

- Deliver Real-Time Alerts: Set up automated Slack or email alerts for high-intent keywords or mentions of your competitors. This gets fresh intelligence in front of the right people, right when it matters.

- Hold Regular Intel Briefings: Carve out a few minutes in your weekly team meetings to share the latest market findings. This keeps everyone on the same page and sparks cross-functional brainstorming.

- Build a Centralized Hub: Create a shared dashboard or a simple repository where key insights are stored and easy for anyone to find. This stops valuable intel from getting buried in email threads or lost on someone's desktop.

Answering Your Market Intelligence Questions

As teams start digging into market intelligence, the same few questions always pop up. Getting straight answers is the key to building a program that actually delivers value instead of just creating more noise for your team to sift through.

Let's tackle some of the most common ones to clear things up.

How Is Market Intelligence Different from Just Collecting Data?

This is probably the most important distinction to get right from the start.

Simply collecting data is like having a pile of bricks—it’s just raw material. Market intelligence is the process of looking at those bricks, understanding their quality, and then using them to build a solid house. It's about creating a complete strategic picture.

Data collection is passive. Intelligence is active. It’s all about the analysis and interpretation needed to answer the "so what?" question. It connects the dots between a competitor’s new pricing, a trending complaint on Reddit, and your latest product reviews to tell a story that guides your next move.

Market intelligence isn't about how much data you can pile up. It's about the quality of the insights you pull from it and your ability to act on them to get a specific business result.

What Are the First Steps for a Small Business to Start?

You don't need a huge budget or a dedicated analytics team to get going. For a small business, the best way to start is to keep it simple and focused.

- Define One Clear Goal: Don’t try to boil the ocean. Start with a single, high-impact question. Something like, "What's the biggest complaint people have about our top competitor's product?"

- Choose Your Channels: You don't have to monitor everything. Pick one or two platforms where you know your audience hangs out, like specific subreddits or LinkedIn groups.

- Listen and Learn: For a couple of weeks, just manually track conversations. Look for patterns, recurring pain points, and interesting themes. This small-scale effort will give you immediate value and help you build a case for better tools down the road.

How Can We Measure the ROI of MI Efforts?

Measuring the return on your market intelligence efforts comes down to connecting them to real business results. The trick is to track how the insights you find actually influence your key performance indicators (KPIs).

For instance, let's say your intelligence work uncovers a key competitor weakness, and you use that insight to shape a new marketing campaign. You can measure the impact directly through metrics like:

- Increased Lead Conversion Rates: Did the leads who saw the new messaging convert at a higher rate?

- Improved Win Rates: Did your sales team’s win rate against that specific competitor go up after you armed them with the new intel?

- Growth in Market Share: Over time, are you actually capturing more of the market from the rivals you've been targeting?

By linking your intelligence activities to these concrete business outcomes, you can clearly show the financial value your program is bringing to the table.

Ready to turn social conversations into your biggest competitive advantage? Intently uses AI to find high-intent leads and market insights for you 24/7. Discover how it works at intently.ai.